AI & Technology

What is an AI Financial Advisor? Complete Guide for 2025

By Compordo Team•January 15, 2025•8 min read

# What is an AI Financial Advisor? Complete Guide for 2025

The world of personal finance is undergoing a massive transformation, and AI financial advisors are at the forefront of this revolution. But what exactly is an AI financial advisor, and how can it help you manage your money better?

## Understanding AI Financial Advisors

An AI financial advisor is a software application that uses artificial intelligence and machine learning to provide personalized financial guidance, automate budgeting, track expenses, and help you make smarter money decisions—all without the high costs associated with traditional human advisors.

### How AI Financial Advisors Work

AI financial advisors leverage several advanced technologies:

1. **Machine Learning Algorithms**: These analyze your spending patterns, income, and financial goals to create personalized recommendations.

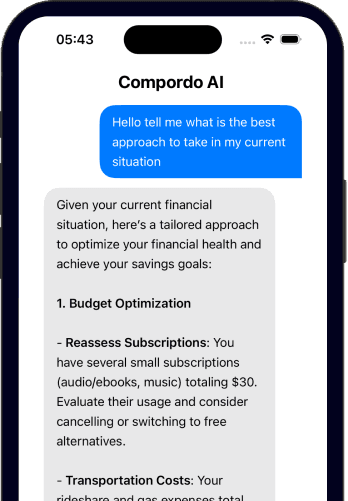

2. **Natural Language Processing**: Allows you to interact with the advisor using everyday language, asking questions and getting instant answers.

3. **Predictive Analytics**: Forecasts future expenses, identifies potential savings opportunities, and alerts you to unusual spending.

4. **Automation**: Automatically categorizes transactions, creates budgets, and tracks your financial progress.

## Key Benefits of AI Financial Advisors

### 1. 24/7 Availability

Unlike human financial advisors who work during business hours, AI advisors are available round-the-clock. Need financial advice at 2 AM? Your AI advisor is there.

### 2. Cost-Effective

Traditional financial advisors typically charge 1-2% of assets under management annually. AI advisors like Compordo offer their services at a fraction of the cost, or even free for early adopters.

### 3. Personalized Insights

AI analyzes your unique financial situation and provides tailored recommendations based on your specific goals, risk tolerance, and spending habits.

### 4. Emotion-Free Decisions

AI doesn't make emotional decisions. It relies on data and proven financial strategies to guide you, helping you avoid costly emotional mistakes.

### 5. Automatic Tracking

Connect your bank accounts once, and the AI automatically tracks all your transactions, categorizes expenses, and updates your budget in real-time.

## AI vs Traditional Financial Advisors

| Feature | AI Financial Advisor | Traditional Advisor |

|---------|---------------------|-------------------|

| Cost | Low/Free | $1,000-$5,000+/year |

| Availability | 24/7 | Business hours |

| Response Time | Instant | Hours to days |

| Bias | Data-driven | Potential bias |

| Scalability | Unlimited users | Limited clients |

## Common Features of AI Financial Advisors

Modern AI financial advisors typically include:

- **Smart Budgeting**: Automatically create and adjust budgets based on your spending patterns

- **Expense Tracking**: Categorize and monitor all your expenses in real-time

- **Investment Monitoring**: Track portfolio performance and get rebalancing suggestions

- **Goal Setting**: Set financial goals and get AI-powered plans to achieve them

- **Bill Reminders**: Never miss a payment with intelligent alerts

- **Savings Recommendations**: Identify opportunities to save money based on your habits

## Is an AI Financial Advisor Right for You?

AI financial advisors are perfect for:

- **Young professionals** starting their financial journey

- **Busy individuals** who want automated money management

- **Budget-conscious users** looking for affordable financial guidance

- **Tech-savvy people** comfortable with digital tools

- **Anyone** wanting to improve their financial literacy

## Getting Started with Compordo

Compordo is an AI-powered financial advisor designed to make managing your finances effortless. Here's what makes it special:

1. **Smart Automation**: Let AI handle budgeting, tracking, and insights while you focus on your goals

2. **Bank-Level Security**: Your data is protected with advanced encryption and security protocols

3. **Real-Time Updates**: Connect via Plaid for instant transaction tracking

4. **Manual Control**: Prefer hands-on management? You can manually input and adjust everything

## The Future of AI Financial Advisors

As AI technology continues to evolve, we can expect:

- More sophisticated personalization

- Better prediction of financial needs

- Integration with more financial services

- Enhanced security features

- Voice-activated financial management

## Conclusion

AI financial advisors represent the future of personal finance management. They combine the best of technology—automation, data analysis, and 24/7 availability—with personalized guidance that adapts to your unique situation.

Whether you're just starting your financial journey or looking to optimize your existing strategy, an AI financial advisor like Compordo can help you achieve your goals faster and more efficiently than ever before.

Ready to experience the future of financial management? Download Compordo today and get free lifetime access as an early adopter!

---

*Have questions about AI financial advisors? Join our [Discord community](https://discord.gg/wxRnk2Pmrt) to connect with other users and get expert advice.*