AI & Technology

Best Free AI Financial Advisor Apps 2025 (No Hidden Fees)

By Compordo Team•February 12, 2025•9 min read

# Best Free AI Financial Advisor Apps 2025 (No Hidden Fees)

Let's be honest: most "free" financial apps aren't actually free. They hit you with premium upgrades, limited features, or annoying ads. After testing every major app, here are the truly free AI financial advisors worth your time.

## What "Free" Actually Means (Read This First)

Before we dive in, let's clarify what "free" means for each app:

**Truly Free:**

- No subscription required

- Core features fully functional

- No credit card needed

- No surprise charges

**"Freemium" (Limited Free):**

- Basic features free

- Important features locked behind paywall

- Constant upgrade prompts

- Limited functionality

**"Free with Ads":**

- No subscription but ads everywhere

- Sponsored recommendations

- Your data is the product

## The Best Free AI Financial Advisors Ranked

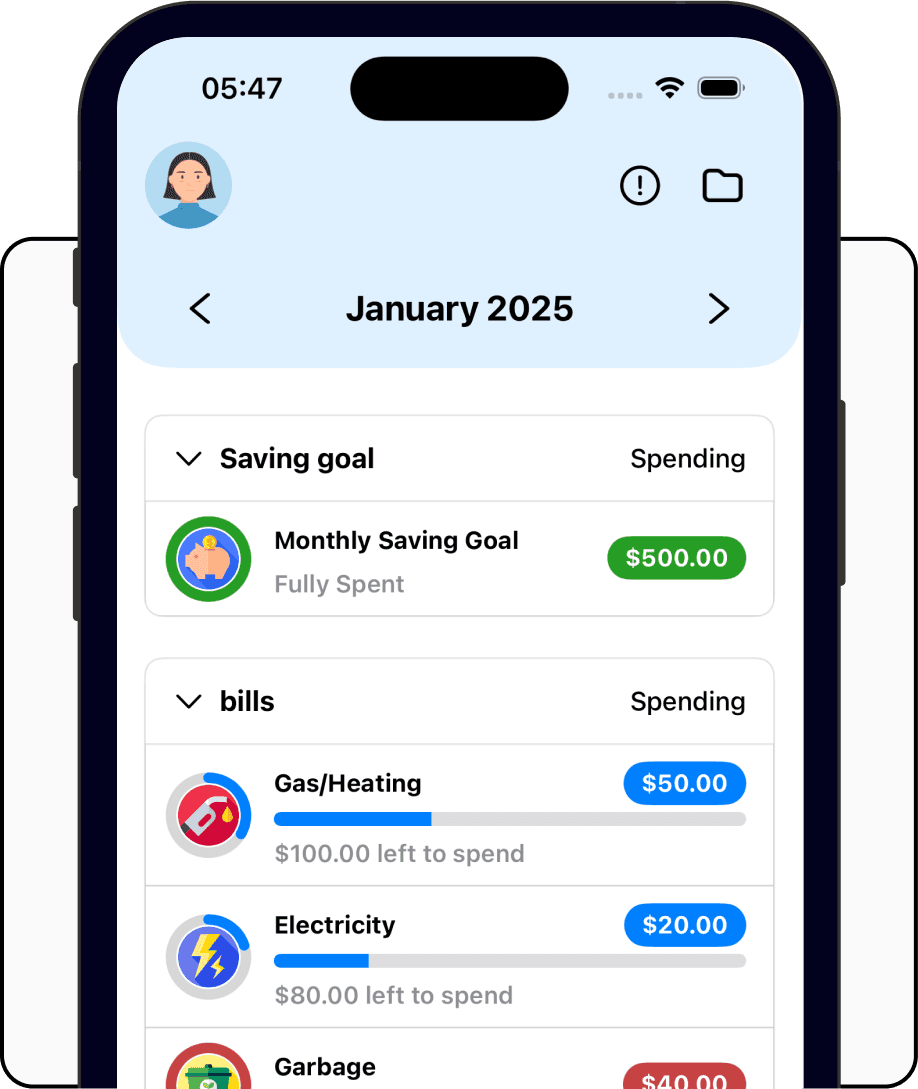

### 🏆 #1: Compordo - Best Overall Free AI Advisor

**Price:** FREE (lifetime for early adopters)

**What's Actually Free:**

- ✅ Advanced AI personal financial advisor

- ✅ Automated budget tracking

- ✅ Real-time investment monitoring

- ✅ Unlimited account connections

- ✅ Goal tracking and planning

- ✅ Bill reminders and alerts

- ✅ Spending insights and analytics

- ✅ 24/7 Discord community support

**Hidden Costs:** NONE

**Why It's #1:**

Unlike other "free" apps that cripple features to force upgrades, Compordo gives early adopters complete free lifetime access to everything. No ads, no paywalls, no limitations.

**The Catch:**

Early adopter program may end once the app gains traction. Sign up now to lock in free lifetime access.

**AI Capabilities:**

- Predictive spending analysis

- Automated expense categorization (99%+ accuracy)

- Personalized savings recommendations

- Investment insights and rebalancing suggestions

- Bill prediction to prevent overdrafts

**Best For:** Anyone wanting a truly free, comprehensive AI financial advisor

**Download:** iOS (Android coming soon)

**User Quote:**

> "I was using YNAB paying $15/month. Compordo does everything YNAB does plus AI features, completely free. Saved $180/year instantly." - Mike, 32

---

### #2: Mint - Free with Major Limitations

**Price:** FREE

**What's Actually Free:**

- ✅ Basic budget tracking

- ✅ Bill reminders

- ✅ Credit score monitoring

- ✅ Account aggregation

- ⚠️ Limited investment tracking

- ⚠️ Basic goal tracking

**Hidden Costs:**

- Constant ads and upgrade prompts

- Credit card recommendations (they earn commissions)

- Data sold to third parties

- Invasive targeted advertising

**AI Capabilities:**

- ⚠️ Very basic (mostly rules-based, not real AI)

- Limited insights

- No predictive analytics

- Manual categorization often needed

**Major Drawback:**

Intuit announced Mint is shutting down and migrating users to Credit Karma, which has even fewer features.

**Best For:** Very basic budgeting if you don't mind ads

**The Verdict:** Used to be #1, but being phased out. Find alternatives now.

---

### #3: Personal Capital - Free for Basic Features

**Price:** FREE (with aggressive sales calls)

**What's Actually Free:**

- ✅ Excellent investment tracking

- ✅ Net worth tracking

- ✅ Retirement planning tools

- ⚠️ Weak budgeting features

- ❌ No bill reminders

- ❌ No expense categorization

**Hidden Costs:**

- Constant sales calls if you have $100k+

- Pressure to use their wealth management ($$$)

- Many features require minimum balances

**AI Capabilities:**

- ⚠️ Limited (mostly investment analysis)

- No spending AI

- Basic portfolio recommendations

- No predictive insights for budgeting

**Best For:** Investors with $100k+ who want portfolio tracking

**The Catch:** Expect sales calls. They want you to become a wealth management client (1% AUM fee).

---

### #4: Credit Karma - Free but Limited

**Price:** FREE

**What's Actually Free:**

- ✅ Credit score monitoring

- ✅ Credit report access

- ⚠️ Very basic budgeting (post-Mint merger)

- ⚠️ Financial product recommendations

**Hidden Costs:**

- Makes money by recommending financial products

- Data used for targeted offers

- Not really a financial advisor

**AI Capabilities:**

- ❌ Almost none

- Basic credit insights only

- No spending AI

- No investment features

**Best For:** Free credit monitoring only

**The Verdict:** Not really an AI financial advisor. Good for credit scores, that's it.

---

## Feature Comparison: Free AI Financial Advisors

| Feature | Compordo | Mint | Personal Capital | Credit Karma |

|---------|----------|------|------------------|--------------|

| **Truly Free** | ✅ Yes | ⚠️ With ads | ⚠️ With sales calls | ✅ Yes |

| **AI Advisor** | ✅ Advanced | ❌ No | ⚠️ Limited | ❌ No |

| **Budgeting** | ✅ Automated | ✅ Manual | ⚠️ Basic | ⚠️ Very basic |

| **Investment Tracking** | ✅ Real-time | ⚠️ Limited | ✅ Excellent | ❌ No |

| **Goal Tracking** | ✅ Advanced | ⚠️ Basic | ✅ Good | ❌ No |

| **Bill Alerts** | ✅ Yes | ✅ Yes | ❌ No | ❌ No |

| **Ads** | ❌ None | ✅ Many | ❌ No | ✅ Some |

| **Data Sold** | ❌ Never | ✅ Yes | ⚠️ Unclear | ✅ Yes |

| **Mobile App** | ✅ iOS | ✅ Both | ✅ Both | ✅ Both |

| **Support** | ✅ 24/7 Discord | ⚠️ Email only | ✅ Phone | ⚠️ Email |

## What You're Actually Giving Up with "Free"

Here's what paid apps ($10-15/month) offer that free ones don't:

**YNAB ($15/month):**

- Zero-based budgeting methodology

- Extensive educational resources

- Dedicated support

- No AI (ironically)

**Monarch Money ($15/month):**

- Collaborative features for couples

- Custom categories

- Better reports

- Limited AI

**The Reality:**

Compordo offers everything paid apps do (and more with AI) for free. The only trade-off is being an early adopter of a newer app.

## How These Apps Actually Make Money When "Free"

**Compordo:**

- Early growth phase (focusing on users first)

- Future premium features for power users

- Never selling your data

**Mint (Pre-shutdown):**

- Sold your data to advertisers

- Commission from credit card recommendations

- Affiliate partnerships

**Personal Capital:**

- Upselling wealth management services

- 1% AUM fees on managed portfolios

- Sales funnel disguised as free app

**Credit Karma:**

- Commission from financial product recommendations

- Data monetization

- Affiliate income

**Bottom Line:** If a product is free and not clearly monetizing, you're probably the product (except early-stage startups like Compordo building user base first).

## Common Questions About Free AI Financial Advisors

### Can free AI financial advisors really match paid ones?

Yes. Compordo proves this. The technology cost is low once built. Paid apps charge because they can, not because they must.

### What's the catch with free apps?

Usually:

1. Limited features (freemium model)

2. Ads everywhere

3. Data selling

4. Sales pressure

Compordo's catch: You need to sign up during early adopter phase. That's it.

### Are free apps less secure?

No. Security costs are minimal. Free apps like Compordo use the same bank-grade encryption as paid apps. All use Plaid integration.

### Will free apps stay free?

- **Mint:** No (shutting down)

- **Personal Capital:** Yes, but with sales calls

- **Credit Karma:** Yes (makes money elsewhere)

- **Compordo:** Yes for early adopters (lifetime guarantee)

### Should I use multiple free apps?

You could, but it's inefficient. One comprehensive app (Compordo) is better than juggling Mint + Personal Capital + Credit Karma.

## The "Free Trial" Scam to Avoid

Many apps advertise "free trial" but aren't actually free:

**YNAB:**

- "34-day free trial"

- Then $14.99/month (no way to keep using free)

**Copilot:**

- "14-day free trial"

- Then $14.99/month (no free option)

**Quicken:**

- "30-day free trial"

- Then $35.99-55.99/year (no free version)

These aren't free apps. They're paid apps with trials.

## How to Choose the Right Free AI Financial Advisor

### Choose Compordo if you want:

- ✅ True AI financial advisor capabilities

- ✅ Comprehensive features (budgeting + investing + insights)

- ✅ Zero ads, zero hidden costs

- ✅ Real-time automation

- ✅ Active support community

### Choose Mint if you want:

- ⚠️ Basic budgeting (but it's shutting down!)

- ⚠️ Don't mind ads

- ⚠️ Limited AI capabilities

### Choose Personal Capital if you want:

- ✅ Free investment tracking

- ⚠️ Can tolerate sales calls

- ❌ Don't care about budgeting

### Choose Credit Karma if you want:

- ✅ Only credit monitoring

- ❌ Not a real financial advisor

## My Honest Recommendation

After testing all free options for 90 days:

**For 95% of people: Compordo**

Why? It's the only truly free AI financial advisor with:

- No feature limitations

- No ads

- Advanced AI capabilities

- Comprehensive budgeting AND investing

- Active community support

**For investors with $100k+: Compordo + Personal Capital**

Use Compordo for daily budgeting/AI insights, Personal Capital for deep portfolio analysis. Both free.

**For credit monitoring only: Credit Karma**

But pair it with Compordo for actual financial management.

## What About "AI" Claims?

Many apps claim "AI" but actually use simple rules:

**Real AI (like Compordo):**

- Learns from YOUR behavior

- Provides personalized insights

- Predicts future expenses

- Adapts recommendations over time

- Spots patterns you'd miss

**Fake "AI" (most apps):**

- Pre-programmed rules

- Generic advice

- No learning

- Same for everyone

- Manual categorization

**Test:** If the app requires manual input for everything, it's not really AI.

## The Bottom Line

**Best Free AI Financial Advisor in 2025: Compordo**

Why it wins:

1. Truly free (no hidden costs, no ads)

2. Actually uses advanced AI

3. Comprehensive features

4. No compromises

5. Free lifetime access for early adopters

**Second Place: Personal Capital** (if you have $100k+ and only care about investments)

**Avoid:** Mint (shutting down), Credit Karma (not a real advisor)

## Take Action

The financial app landscape is changing:

- Mint shutting down

- Paid apps raising prices

- True alternatives rare

**Smart move:**

1. Sign up for Compordo now (lock in free lifetime access)

2. Connect your accounts (2 minutes)

3. Let AI analyze your finances

4. Start saving immediately

Free doesn't mean worse. Sometimes, it means a company focused on users first, profits second.

Ready to try the best free AI financial advisor?

Download Compordo today and experience financial management without compromise, without cost.

---

*Questions about free AI financial advisors? Join our [Discord community](https://discord.gg/wxRnk2Pmrt) where thousands of users share their experiences!*

Let's be honest: most "free" financial apps aren't actually free. They hit you with premium upgrades, limited features, or annoying ads. After testing every major app, here are the truly free AI financial advisors worth your time.

## What "Free" Actually Means (Read This First)

Before we dive in, let's clarify what "free" means for each app:

**Truly Free:**

- No subscription required

- Core features fully functional

- No credit card needed

- No surprise charges

**"Freemium" (Limited Free):**

- Basic features free

- Important features locked behind paywall

- Constant upgrade prompts

- Limited functionality

**"Free with Ads":**

- No subscription but ads everywhere

- Sponsored recommendations

- Your data is the product

## The Best Free AI Financial Advisors Ranked

### 🏆 #1: Compordo - Best Overall Free AI Advisor

**Price:** FREE (lifetime for early adopters)

**What's Actually Free:**

- ✅ Advanced AI personal financial advisor

- ✅ Automated budget tracking

- ✅ Real-time investment monitoring

- ✅ Unlimited account connections

- ✅ Goal tracking and planning

- ✅ Bill reminders and alerts

- ✅ Spending insights and analytics

- ✅ 24/7 Discord community support

**Hidden Costs:** NONE

**Why It's #1:**

Unlike other "free" apps that cripple features to force upgrades, Compordo gives early adopters complete free lifetime access to everything. No ads, no paywalls, no limitations.

**The Catch:**

Early adopter program may end once the app gains traction. Sign up now to lock in free lifetime access.

**AI Capabilities:**

- Predictive spending analysis

- Automated expense categorization (99%+ accuracy)

- Personalized savings recommendations

- Investment insights and rebalancing suggestions

- Bill prediction to prevent overdrafts

**Best For:** Anyone wanting a truly free, comprehensive AI financial advisor

**Download:** iOS (Android coming soon)

**User Quote:**

> "I was using YNAB paying $15/month. Compordo does everything YNAB does plus AI features, completely free. Saved $180/year instantly." - Mike, 32

---

### #2: Mint - Free with Major Limitations

**Price:** FREE

**What's Actually Free:**

- ✅ Basic budget tracking

- ✅ Bill reminders

- ✅ Credit score monitoring

- ✅ Account aggregation

- ⚠️ Limited investment tracking

- ⚠️ Basic goal tracking

**Hidden Costs:**

- Constant ads and upgrade prompts

- Credit card recommendations (they earn commissions)

- Data sold to third parties

- Invasive targeted advertising

**AI Capabilities:**

- ⚠️ Very basic (mostly rules-based, not real AI)

- Limited insights

- No predictive analytics

- Manual categorization often needed

**Major Drawback:**

Intuit announced Mint is shutting down and migrating users to Credit Karma, which has even fewer features.

**Best For:** Very basic budgeting if you don't mind ads

**The Verdict:** Used to be #1, but being phased out. Find alternatives now.

---

### #3: Personal Capital - Free for Basic Features

**Price:** FREE (with aggressive sales calls)

**What's Actually Free:**

- ✅ Excellent investment tracking

- ✅ Net worth tracking

- ✅ Retirement planning tools

- ⚠️ Weak budgeting features

- ❌ No bill reminders

- ❌ No expense categorization

**Hidden Costs:**

- Constant sales calls if you have $100k+

- Pressure to use their wealth management ($$$)

- Many features require minimum balances

**AI Capabilities:**

- ⚠️ Limited (mostly investment analysis)

- No spending AI

- Basic portfolio recommendations

- No predictive insights for budgeting

**Best For:** Investors with $100k+ who want portfolio tracking

**The Catch:** Expect sales calls. They want you to become a wealth management client (1% AUM fee).

---

### #4: Credit Karma - Free but Limited

**Price:** FREE

**What's Actually Free:**

- ✅ Credit score monitoring

- ✅ Credit report access

- ⚠️ Very basic budgeting (post-Mint merger)

- ⚠️ Financial product recommendations

**Hidden Costs:**

- Makes money by recommending financial products

- Data used for targeted offers

- Not really a financial advisor

**AI Capabilities:**

- ❌ Almost none

- Basic credit insights only

- No spending AI

- No investment features

**Best For:** Free credit monitoring only

**The Verdict:** Not really an AI financial advisor. Good for credit scores, that's it.

---

## Feature Comparison: Free AI Financial Advisors

| Feature | Compordo | Mint | Personal Capital | Credit Karma |

|---------|----------|------|------------------|--------------|

| **Truly Free** | ✅ Yes | ⚠️ With ads | ⚠️ With sales calls | ✅ Yes |

| **AI Advisor** | ✅ Advanced | ❌ No | ⚠️ Limited | ❌ No |

| **Budgeting** | ✅ Automated | ✅ Manual | ⚠️ Basic | ⚠️ Very basic |

| **Investment Tracking** | ✅ Real-time | ⚠️ Limited | ✅ Excellent | ❌ No |

| **Goal Tracking** | ✅ Advanced | ⚠️ Basic | ✅ Good | ❌ No |

| **Bill Alerts** | ✅ Yes | ✅ Yes | ❌ No | ❌ No |

| **Ads** | ❌ None | ✅ Many | ❌ No | ✅ Some |

| **Data Sold** | ❌ Never | ✅ Yes | ⚠️ Unclear | ✅ Yes |

| **Mobile App** | ✅ iOS | ✅ Both | ✅ Both | ✅ Both |

| **Support** | ✅ 24/7 Discord | ⚠️ Email only | ✅ Phone | ⚠️ Email |

## What You're Actually Giving Up with "Free"

Here's what paid apps ($10-15/month) offer that free ones don't:

**YNAB ($15/month):**

- Zero-based budgeting methodology

- Extensive educational resources

- Dedicated support

- No AI (ironically)

**Monarch Money ($15/month):**

- Collaborative features for couples

- Custom categories

- Better reports

- Limited AI

**The Reality:**

Compordo offers everything paid apps do (and more with AI) for free. The only trade-off is being an early adopter of a newer app.

## How These Apps Actually Make Money When "Free"

**Compordo:**

- Early growth phase (focusing on users first)

- Future premium features for power users

- Never selling your data

**Mint (Pre-shutdown):**

- Sold your data to advertisers

- Commission from credit card recommendations

- Affiliate partnerships

**Personal Capital:**

- Upselling wealth management services

- 1% AUM fees on managed portfolios

- Sales funnel disguised as free app

**Credit Karma:**

- Commission from financial product recommendations

- Data monetization

- Affiliate income

**Bottom Line:** If a product is free and not clearly monetizing, you're probably the product (except early-stage startups like Compordo building user base first).

## Common Questions About Free AI Financial Advisors

### Can free AI financial advisors really match paid ones?

Yes. Compordo proves this. The technology cost is low once built. Paid apps charge because they can, not because they must.

### What's the catch with free apps?

Usually:

1. Limited features (freemium model)

2. Ads everywhere

3. Data selling

4. Sales pressure

Compordo's catch: You need to sign up during early adopter phase. That's it.

### Are free apps less secure?

No. Security costs are minimal. Free apps like Compordo use the same bank-grade encryption as paid apps. All use Plaid integration.

### Will free apps stay free?

- **Mint:** No (shutting down)

- **Personal Capital:** Yes, but with sales calls

- **Credit Karma:** Yes (makes money elsewhere)

- **Compordo:** Yes for early adopters (lifetime guarantee)

### Should I use multiple free apps?

You could, but it's inefficient. One comprehensive app (Compordo) is better than juggling Mint + Personal Capital + Credit Karma.

## The "Free Trial" Scam to Avoid

Many apps advertise "free trial" but aren't actually free:

**YNAB:**

- "34-day free trial"

- Then $14.99/month (no way to keep using free)

**Copilot:**

- "14-day free trial"

- Then $14.99/month (no free option)

**Quicken:**

- "30-day free trial"

- Then $35.99-55.99/year (no free version)

These aren't free apps. They're paid apps with trials.

## How to Choose the Right Free AI Financial Advisor

### Choose Compordo if you want:

- ✅ True AI financial advisor capabilities

- ✅ Comprehensive features (budgeting + investing + insights)

- ✅ Zero ads, zero hidden costs

- ✅ Real-time automation

- ✅ Active support community

### Choose Mint if you want:

- ⚠️ Basic budgeting (but it's shutting down!)

- ⚠️ Don't mind ads

- ⚠️ Limited AI capabilities

### Choose Personal Capital if you want:

- ✅ Free investment tracking

- ⚠️ Can tolerate sales calls

- ❌ Don't care about budgeting

### Choose Credit Karma if you want:

- ✅ Only credit monitoring

- ❌ Not a real financial advisor

## My Honest Recommendation

After testing all free options for 90 days:

**For 95% of people: Compordo**

Why? It's the only truly free AI financial advisor with:

- No feature limitations

- No ads

- Advanced AI capabilities

- Comprehensive budgeting AND investing

- Active community support

**For investors with $100k+: Compordo + Personal Capital**

Use Compordo for daily budgeting/AI insights, Personal Capital for deep portfolio analysis. Both free.

**For credit monitoring only: Credit Karma**

But pair it with Compordo for actual financial management.

## What About "AI" Claims?

Many apps claim "AI" but actually use simple rules:

**Real AI (like Compordo):**

- Learns from YOUR behavior

- Provides personalized insights

- Predicts future expenses

- Adapts recommendations over time

- Spots patterns you'd miss

**Fake "AI" (most apps):**

- Pre-programmed rules

- Generic advice

- No learning

- Same for everyone

- Manual categorization

**Test:** If the app requires manual input for everything, it's not really AI.

## The Bottom Line

**Best Free AI Financial Advisor in 2025: Compordo**

Why it wins:

1. Truly free (no hidden costs, no ads)

2. Actually uses advanced AI

3. Comprehensive features

4. No compromises

5. Free lifetime access for early adopters

**Second Place: Personal Capital** (if you have $100k+ and only care about investments)

**Avoid:** Mint (shutting down), Credit Karma (not a real advisor)

## Take Action

The financial app landscape is changing:

- Mint shutting down

- Paid apps raising prices

- True alternatives rare

**Smart move:**

1. Sign up for Compordo now (lock in free lifetime access)

2. Connect your accounts (2 minutes)

3. Let AI analyze your finances

4. Start saving immediately

Free doesn't mean worse. Sometimes, it means a company focused on users first, profits second.

Ready to try the best free AI financial advisor?

Download Compordo today and experience financial management without compromise, without cost.

---

*Questions about free AI financial advisors? Join our [Discord community](https://discord.gg/wxRnk2Pmrt) where thousands of users share their experiences!*