AI & Technology

AI vs Human Financial Advisors: Which is Right for You in 2025?

By Compordo Team•January 21, 2025•12 min read

# AI vs Human Financial Advisors: Which is Right for You in 2025?

Choosing between an AI financial advisor and a human financial advisor is one of the most important financial decisions you'll make in 2025. As artificial intelligence transforms personal finance, many people wonder: can AI really replace human financial advisors? This comprehensive comparison will help you understand the strengths, limitations, and ideal use cases for both options.

## Understanding the Two Options

### What is an AI Financial Advisor?

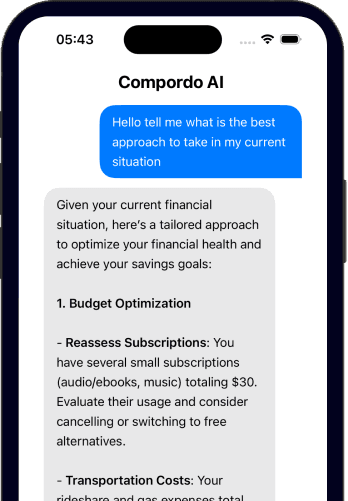

An AI financial advisor is a software-powered platform that uses artificial intelligence, machine learning, and predictive analytics to provide automated financial guidance. These digital advisors analyze your financial data 24/7 and deliver personalized recommendations for budgeting, investing, and financial planning—without human intervention.

Popular AI financial advisor features include:

- Automated budget creation based on spending patterns

- Real-time investment portfolio monitoring

- Predictive cash flow forecasting

- Instant answers to financial questions

- AI-powered expense categorization

### What is a Human Financial Advisor?

A human financial advisor is a certified professional (often a CFP, CFA, or similar) who provides personalized financial advice based on years of training and experience. They meet with clients regularly to discuss goals, review portfolios, and adjust strategies based on life changes.

Traditional human advisor services include:

- Face-to-face financial planning sessions

- Complex estate and tax planning

- Emotional support during market volatility

- Holistic life-stage financial guidance

- Customized investment strategies

## AI vs Human Financial Advisors: Detailed Comparison

| Feature | AI Financial Advisor | Human Financial Advisor |

|---------|---------------------|------------------------|

| **Availability** | 24/7 instant access | Business hours, by appointment |

| **Cost** | $0-$20/month or 0.25%-0.50% AUM | 1%-2% of assets under management |

| **Minimum Investment** | Often $0-$500 | Typically $100,000-$500,000+ |

| **Response Time** | Instant | Days to weeks |

| **Personalization** | Data-driven, algorithmic | Experience-based, holistic |

| **Emotional Intelligence** | Limited | High - understands life complexities |

| **Complex Planning** | Basic to intermediate | Advanced (estate, tax, business) |

| **Bias** | Algorithm-based (can have built-in biases) | Human judgment (can be subjective) |

| **Scalability** | Unlimited users simultaneously | Limited by advisor's time |

| **Learning Curve** | Quick, intuitive interfaces | Requires building trust over time |

## The Key Advantages of AI Financial Advisors

### 1. **Accessibility for Everyone**

AI financial advisors democratize access to sophisticated financial tools. You don't need $100,000 to get started—many AI platforms work with any income level.

**Real-world impact:** According to industry research, AI-powered budgeting tools deliver **50% better forecasting accuracy** and save users **5+ hours per month** on financial management tasks.

### 2. **Cost-Effectiveness**

While human advisors typically charge 1-2% of assets under management annually (that's $1,000-$2,000 per year on a $100,000 portfolio), AI financial advisors cost a fraction—often $0-$20/month for premium features.

**Example savings:**

- $100,000 portfolio with human advisor: $1,000-$2,000/year

- $100,000 portfolio with AI advisor: $0-$240/year

- **Annual savings: $760-$2,000**

### 3. **Continuous Monitoring**

AI financial advisors never sleep. They monitor your accounts 24/7, detect unusual transactions, identify spending patterns, and alert you to potential issues instantly.

**Fraud detection:** AI systems cut financial fraud by approximately **60%** compared to traditional monitoring methods, catching suspicious activity in real-time.

### 4. **Emotion-Free Decision Making**

AI advisors aren't influenced by fear, greed, or market panic. They follow data-driven strategies consistently, which can prevent costly emotional investing mistakes.

### 5. **Speed and Efficiency**

Need to know if you can afford a major purchase? Want to see how a career change affects retirement? AI financial advisors provide instant simulations and answers—no waiting for appointment scheduling.

## The Key Advantages of Human Financial Advisors

### 1. **Holistic Life Planning**

Human advisors understand that personal finance isn't just about numbers—it's about life goals, family dynamics, career transitions, and personal values. They can factor in nuances that AI might miss.

**Example scenarios where humans excel:**

- Planning finances through a divorce

- Coordinating care for aging parents

- Balancing competing family priorities

- Navigating complex business ownership

- Estate planning with family complications

### 2. **Complex Tax and Estate Planning**

Advanced tax strategies, trust creation, charitable giving structures, and multi-generational wealth transfer require sophisticated planning that goes beyond current AI capabilities.

### 3. **Accountability and Emotional Support**

A good human advisor provides motivation, encouragement, and accountability. During market downturns, they calm fears and keep you focused on long-term goals. This emotional intelligence is invaluable.

### 4. **Adaptability to Unique Situations**

Every financial situation has unique wrinkles. Human advisors can think creatively and adapt strategies to unusual circumstances that fall outside typical AI algorithm parameters.

### 5. **Trust and Relationship**

Many people value the personal relationship and trust built over years with a human advisor. There's comfort in knowing someone personally understands your entire financial picture.

## The Limitations You Need to Know

### AI Financial Advisor Limitations

1. **No Emotional Intelligence:** AI can't sense when you're anxious about money or provide reassurance during tough times

2. **Limited Complex Planning:** Advanced estate planning, business succession, and intricate tax strategies may exceed AI capabilities

3. **Algorithm Dependence:** AI is only as good as its programming and training data—biases can be built in

4. **Generic Advice for Edge Cases:** Unusual financial situations may not fit AI's programmed scenarios

5. **Technology Barriers:** Some users struggle with digital-only interfaces

### Human Financial Advisor Limitations

1. **High Costs:** 1-2% annual fees compound over decades, potentially costing hundreds of thousands

2. **Minimum Investment Requirements:** Many advisors won't work with clients below $100,000-$500,000

3. **Limited Availability:** You can only meet during business hours, and getting advice requires scheduling

4. **Potential Conflicts of Interest:** Some advisors earn commissions on products they recommend

5. **Slower Response Times:** Questions may take days or weeks to answer

6. **Human Bias:** Advisors can be influenced by their own experiences, prejudices, or firm pressures

## The Hybrid Approach: Best of Both Worlds

Here's the reality that financial experts acknowledge: **AI doesn't replace human advisors—it complements them.**

Research shows that by 2025, approximately **30% of investments are managed by AI-driven robo-advisors**, and most successful financial advisory firms now integrate AI tools into their human-led services.

### Who Should Choose an AI Financial Advisor?

AI financial advisors are ideal if you:

✅ Are early in your wealth-building journey ($0-$100,000 in assets)

✅ Have straightforward financial needs (budgeting, basic investing, debt payoff)

✅ Want 24/7 access to financial tools and insights

✅ Are comfortable with technology and digital interfaces

✅ Want to minimize advisory fees

✅ Need automated expense tracking and budget management

✅ Prefer data-driven, emotion-free investment strategies

**Best AI financial advisor platforms:** Compordo (best for comprehensive AI budgeting and investment tracking), Betterment, Wealthfront, Ellevest

### Who Should Choose a Human Financial Advisor?

Human financial advisors are ideal if you:

✅ Have complex financial needs (estate planning, business ownership, multiple properties)

✅ Have substantial assets ($500,000+) where the 1-2% fee is worth comprehensive service

✅ Value personal relationships and face-to-face communication

✅ Need sophisticated tax planning strategies

✅ Require emotional support and accountability

✅ Have unique circumstances requiring creative problem-solving

✅ Are planning multi-generational wealth transfer

### The Hybrid Solution

Consider this smart approach:

1. **Use AI for day-to-day management:** Let AI tools handle budgeting, expense tracking, basic portfolio monitoring, and routine financial tasks

2. **Consult human advisors for major decisions:** Work with a fee-only CFP for major life events (home purchase, retirement planning, inheritance, divorce)

3. **Reassess annually:** As your wealth grows, revisit whether you need more human guidance

This hybrid approach gives you AI's efficiency and cost savings for 90% of tasks, while reserving human expertise for the 10% of complex situations where it truly adds value.

## Cost Comparison Over 20 Years

Let's look at real numbers. Assume you invest $100,000 today and contribute $500/month for 20 years at 7% annual return:

### Human Advisor (1.5% annual fee):

- Portfolio value after 20 years: **$312,483**

- Fees paid: **$87,517**

### AI Advisor (0.25% annual fee):

- Portfolio value after 20 years: **$367,891**

- Fees paid: **$32,109**

**Difference: $55,408 more with AI advisor**

Even factoring in occasional hourly consultations with a human advisor ($200-$400/hour × 5 consultations = $1,000-$2,000), the AI approach saves tens of thousands over time.

## The Future: AI and Human Advisors Working Together

The financial advisory industry isn't moving toward "AI vs human"—it's moving toward "AI + human."

Forward-thinking human advisors now use AI tools to:

- Automate routine portfolio monitoring

- Identify client opportunities faster

- Provide instant answers to simple questions

- Improve forecasting accuracy

- Free up time for high-value personal interactions

Meanwhile, AI platforms are adding:

- On-demand access to human advisors for complex questions

- Hybrid subscription models

- More sophisticated planning capabilities

## Making Your Decision

Ask yourself these questions:

1. **What's my current financial situation?**

- Under $100,000: AI advisor likely sufficient

- $100,000-$500,000: AI advisor with occasional human consults

- $500,000+: Consider traditional human advisor or hybrid approach

2. **How complex are my financial needs?**

- Straightforward: AI is perfect

- Moderately complex: Hybrid approach

- Very complex: Human advisor likely necessary

3. **What's my comfort level with technology?**

- High comfort: AI works great

- Low comfort: Human advisor may be better

4. **What's my learning style?**

- Self-directed: AI tools empower you

- Need guidance: Human touch may help

5. **Can I afford 1-2% annual fees?**

- If that's $10,000+/year, is the human service worth it vs. AI + occasional consults?

## Conclusion: It's Not One or the Other

The question isn't really "AI vs human financial advisors"—it's "**how can I best combine AI efficiency with human expertise for my unique situation?**"

For most people in 2025, the answer is:

- Start with an AI financial advisor platform for daily money management

- Use AI for budgeting, expense tracking, basic investing, and financial forecasting

- Consult fee-only human advisors for major life transitions and complex planning

- Reassess as your wealth and complexity grow

Remember: **AI democratizes access but doesn't replace wisdom**. The best financial strategy uses technology for efficiency while reserving human judgment for complexity.

### Ready to Start with AI Financial Advice?

Try [Compordo's AI personal financial advisor](https://www.compordo.com) free—get 24/7 smart budgeting, automated investment tracking, and AI-powered financial insights without the hefty advisor fees.

[Start Free with Compordo →](https://www.compordo.com)

---

*Still have questions about AI vs human financial advisors? Join our [Discord community](https://discord.gg/wxRnk2Pmrt) where thousands of users discuss their experiences with both!*