Security & Privacy

Is AI Financial Advice Safe? Complete Security & Privacy Guide 2025

By Compordo Team•January 21, 2025•11 min read

# Is AI Financial Advice Safe? Complete Security & Privacy Guide 2025

"Is AI financial advice safe?" is one of the most common questions people ask when considering AI-powered financial planning tools. With AI financial advisors handling sensitive banking information, investment accounts, and personal financial data, security and privacy concerns are absolutely valid.

This comprehensive guide examines the safety of AI financial advice, explores potential risks, and provides practical guidance on using AI financial tools securely in 2025.

## The Short Answer: Is AI Financial Advice Safe?

**Yes, AI financial advice from reputable platforms is generally safe**—often safer than traditional methods—when providers implement proper security measures like bank-level encryption, read-only account access, and compliance with financial regulations.

However, like any financial service, AI financial advisors carry risks that vary by provider. Understanding these risks and choosing secure platforms is essential for protecting your financial data.

## Understanding AI Financial Advisor Security

### How AI Financial Tools Access Your Data

AI financial advisors typically connect to your accounts through:

#### 1. **Aggregation Services (Plaid, Yodlee, Finicity)**

Most AI financial apps don't connect directly to banks. Instead, they use secure intermediary services:

- You provide bank credentials ONCE to the aggregation service (not the AI app)

- Aggregation service connects to your bank using secure APIs

- AI app receives read-only transaction data from aggregation service

- **Your credentials are never stored by the AI financial advisor**

**Security benefit:** Even if the AI app were breached, hackers wouldn't gain direct bank access

#### 2. **OAuth and API Connections**

Modern banking APIs use OAuth (like "Sign in with Google"):

- You authenticate directly with your bank

- Bank provides temporary access token to AI app

- Token grants read-only access to specific data

- You can revoke access anytime through your bank

- **No passwords shared** with AI financial advisor

**Industry standard:** By 2025, most major banks support OAuth connections, dramatically improving security

### Security Measures Used by Reputable AI Financial Advisors

#### 1. **256-Bit Bank-Level Encryption**

Reputable AI financial platforms use AES-256 encryption—the same standard used by banks and military:

- Data encrypted "in transit" (while moving between you and servers)

- Data encrypted "at rest" (while stored on servers)

- **Virtually impossible to decrypt** without proper keys

**What to verify:** Check provider's security page for "256-bit encryption" or "bank-level encryption"

#### 2. **Read-Only Access**

Legitimate AI financial advisors request **read-only** permissions:

- Can view account balances and transactions

- **Cannot initiate transfers** or make payments

- **Cannot change account settings** or passwords

- **Cannot withdraw funds**

**Red flag:** Any service requesting full account access or ability to move money (unless explicitly robo-advisor managing investments)

#### 3. **Two-Factor Authentication (2FA)**

Strong AI financial platforms require 2FA:

- Something you know (password)

- Something you have (phone, authenticator app, security key)

- **Dramatically reduces** unauthorized access risk

**Best practice:** Always enable 2FA on financial apps and use authenticator apps (Google Authenticator, Authy) rather than SMS

#### 4. **SOC 2 Type II Compliance**

SOC 2 Type II is an independent audit verifying security controls:

- Third-party auditors test security measures

- Issued only after passing rigorous examination

- Must be renewed annually with continuous monitoring

**What to look for:** Reputable providers prominently display SOC 2 compliance

#### 5. **Regular Security Audits and Penetration Testing**

Top AI financial platforms:

- Hire external security firms for penetration testing

- Conduct regular code reviews

- Maintain bug bounty programs

- Disclose security practices transparently

### How AI Cuts Fraud by 60%

One significant security BENEFIT of AI financial advisors: **AI reduces financial fraud by approximately 60%** through:

#### Real-Time Transaction Monitoring

AI analyzes every transaction instantly:

- Detects unusual spending patterns

- Identifies potentially fraudulent charges

- Alerts you within minutes (vs. days/weeks with banks)

**Example:** You typically spend $30-50 at gas stations. A $299 charge triggers immediate AI alert, catching fraud before significant damage.

#### Behavioral Analysis

AI learns your normal financial behavior:

- Typical spending locations

- Average transaction amounts

- Normal banking hours

- Regular payees

Deviations trigger security alerts.

#### Subscription Tracking

AI catches unauthorized recurring charges:

- Forgotten subscriptions you didn't cancel

- Free trials that auto-converted to paid

- Fraudulent recurring charges

**Average savings:** $200-400/year in forgotten subscriptions

## Privacy Concerns with AI Financial Advice

While security focuses on preventing unauthorized access, privacy concerns center on what AI financial platforms DO with your data.

### What Data Do AI Financial Advisors Collect?

Typical data collection includes:

**Financial Data:**

- Account balances and transaction history

- Income and expenses

- Investment holdings and performance

- Credit card and loan information

**Personal Data:**

- Name, email, phone number

- Date of birth

- Location (for tax and regulatory purposes)

**Usage Data:**

- App usage patterns

- Features you use most

- Questions asked to AI assistant

### How AI Financial Platforms Use Your Data

#### Legitimate Uses:

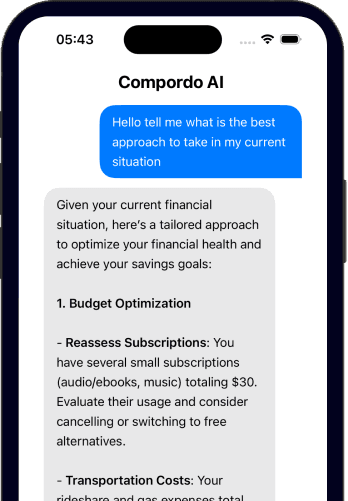

✅ **Personalized financial recommendations** based on your spending patterns

✅ **AI model training** to improve accuracy and features (typically anonymized)

✅ **Fraud detection** and security monitoring

✅ **Product development** to enhance user experience

✅ **Regulatory compliance** and reporting (where required by law)

#### Privacy Red Flags:

❌ **Selling your data** to third-party advertisers or data brokers

❌ **Sharing identifiable financial information** without explicit consent

❌ **Using data for unrelated purposes** beyond financial services

❌ **Retaining data indefinitely** after account closure

❌ **Unclear or vague privacy policies** that don't specify data use

### Key Privacy Questions to Ask

Before trusting an AI financial advisor with your data, verify:

1. **Is my data sold to third parties?**

- Reputable platforms: NO (or only anonymized aggregate data)

- Red flag: Yes, for targeted advertising

2. **Can I delete my data?**

- Should be YES, with clear deletion process

- GDPR/CCPA give you right to data deletion

3. **How long is my data retained?**

- After account closure, most retain 6-12 months for regulatory compliance

- Should then be permanently deleted

4. **Who has access to my financial data?**

- Should be limited to employees with legitimate need

- Third parties (aggregation services) should have strict data controls

5. **What happens if the company is acquired?**

- Privacy policy should address this scenario

- You should be notified with option to delete account before data transfer

## Comparing AI Financial Advisor Security to Traditional Methods

| Security Aspect | AI Financial Advisor | Traditional Advisor | Manual Spreadsheet |

|----------------|---------------------|--------------------|--------------------|

| **Data encryption** | 256-bit bank-level | Varies (email often unencrypted) | Typically none |

| **Account access** | Read-only via secure API | May require full credentials | You manually enter data |

| **Fraud detection** | Real-time AI monitoring (60% better) | Periodic review | Manual checks |

| **Physical security** | Cloud servers with redundancy | Paper files in office | Computer/files at home |

| **2FA protection** | Usually required | Rarely used | Depends on your device |

| **Human error** | Minimal (automated) | Possible (email mishaps) | High (lost laptop, theft) |

| **Breach risk** | Centralized target but hardened | Smaller target, often less secure | Local but vulnerable if infected |

**Verdict:** Reputable AI financial advisors are typically MORE secure than traditional methods, especially manual tracking.

## Assessing the Safety of Specific AI Financial Platforms

### Security Features Comparison (Top AI Financial Advisors)

| Platform | Bank-Level Encryption | Read-Only Access | 2FA | SOC 2 Compliance | Data Selling |

|----------|----------------------|------------------|-----|------------------|-------------|

| **Compordo** | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes | ❌ No |

| **Wealthfront** | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes | ❌ No |

| **Betterment** | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes | ❌ No |

| **Personal Capital (Empower)** | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes | ❌ No |

| **Monarch Money** | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes | ❌ No |

### Red Flags: When NOT to Trust an AI Financial Advisor

🚩 **No encryption disclosure** or vague security language

🚩 **Requests full account access** (ability to transfer funds) for budgeting app

🚩 **No 2FA option** available

🚩 **Privacy policy permits data selling** to third parties

🚩 **Lacks SOC 2 or equivalent security certification**

🚩 **No clear data deletion policy**

🚩 **Requires unnecessary permissions** (why does a budgeting app need camera access?)

🚩 **Headquartered in country with weak privacy laws** (check data storage location)

🚩 **Recent major security breach** with poor response/communication

🚩 **Extremely cheap or free** with unclear business model (if you're not paying, you're the product)

## Specific AI Security Risks and Mitigation

### Risk 1: Data Breach

**Risk:** Hackers breach AI financial platform's servers and access user data

**Likelihood:** LOW for reputable platforms (Plaid, used by most apps, has never had major breach)

**Mitigation:**

- Choose platforms with SOC 2 compliance and security audits

- Enable 2FA on all financial accounts

- Use unique, strong passwords (password manager recommended)

- Monitor accounts regularly for suspicious activity

- Consider credit freeze if highly concerned

**Your protection:** Even if app breached, read-only access means hackers can't steal money directly—they'd need to separately compromise your bank (which has its own security)

### Risk 2: AI Algorithm Errors

**Risk:** AI provides bad financial advice due to programming errors or flawed assumptions

**Likelihood:** MODERATE (AI is good but not perfect)

**Mitigation:**

- Use AI as decision-support tool, not sole source of truth

- Review AI recommendations with critical thinking

- Consult human advisor for major financial decisions ($100k+)

- Start small (test AI advice on small budgeting decisions before retirement planning)

**Remember:** AI delivers 50% better forecasting accuracy than manual methods, but "better" doesn't mean "perfect"

### Risk 3: Privacy Erosion (Data Misuse)

**Risk:** AI platform uses your data for purposes you didn't intend or sells to third parties

**Likelihood:** LOW for established platforms; MODERATE for startups

**Mitigation:**

- Carefully read privacy policy before signing up

- Choose platforms with clear "we don't sell your data" statements

- Check privacy policy annually (companies sometimes change practices)

- Exercise data rights (request data copy, deletion if uncomfortable)

### Risk 4: Account Takeover

**Risk:** Someone gains access to your AI financial advisor account and views sensitive data

**Likelihood:** LOW if you use strong security; MODERATE if you don't

**Mitigation:**

- **Use strong, unique passwords** (15+ characters, password manager)

- **Enable 2FA** (preferably authenticator app, not SMS)

- **Don't share credentials** with anyone

- **Be wary of phishing** (legitimate companies never ask for passwords via email)

- **Use private devices** (don't log into financial apps on public computers)

- **Log out** when finished, especially on shared devices

### Risk 5: Regulatory Changes

**Risk:** Future regulations restrict AI financial services or require data sharing with government

**Likelihood:** MODERATE (regulations are evolving)

**Mitigation:**

- Choose U.S.-based platforms subject to existing financial regulations

- Stay informed about financial privacy legislation

- Maintain traditional relationships (bank, credit union) as backup

## Best Practices for Safe AI Financial Advice Usage

### ✅ DO:

1. **Choose reputable, established platforms** with proven security track records

2. **Enable all available security features** (2FA, biometric login, login alerts)

3. **Use strong, unique passwords** managed by password manager

4. **Regularly review account activity** (AI alerts are great, but double-check)

5. **Connect only necessary accounts** (don't link every financial account if not needed)

6. **Update the app regularly** (updates often include security patches)

7. **Monitor your credit** (free reports annually from annualcreditreport.com)

8. **Read privacy policy** before signing up

9. **Check security certifications** (SOC 2, ISO 27001)

10. **Trust your instincts** (if something feels off, don't use it)

### ❌ DON'T:

1. **Don't use AI financial advisors on public WiFi** without VPN

2. **Don't share login credentials** with anyone

3. **Don't ignore security alerts** from app or banks

4. **Don't use same password** across financial apps

5. **Don't connect to sketchy, unknown platforms**

6. **Don't ignore privacy policy updates** (review annually)

7. **Don't give unnecessary permissions** (camera, contacts, microphone)

8. **Don't trust too-good-to-be-true promises** (10% guaranteed returns, etc.)

9. **Don't forget to disconnect** when you stop using a service

10. **Don't assume "AI" automatically means secure** (verify independently)

## What Happens If There's a Security Breach?

### Reputable Platforms' Response:

1. **Immediate notification** to affected users

2. **Details about what data was accessed** (transparent communication)

3. **Steps to protect yourself** (change passwords, monitor accounts)

4. **Free credit monitoring** (for significant breaches)

5. **Independent security audit** and public report on findings

6. **Enhanced security measures** to prevent recurrence

### Your Response Checklist:

✅ Change password immediately on affected platform

✅ Enable 2FA if not already active

✅ Change passwords on any accounts using same/similar password

✅ Monitor bank/credit accounts daily for 30-60 days

✅ Check credit reports for suspicious activity

✅ Consider credit freeze if Social Security number compromised

✅ Document everything (notifications, actions taken)

✅ Consider closing account if breach was severe or company response poor

### Your Legal Protections:

- **FDIC insurance** protects bank deposits up to $250,000 (doesn't apply to AI app itself, but to underlying banks)

- **SIPC insurance** protects investment accounts up to $500,000 (for brokerage fraud)

- **Federal law limits credit card fraud liability** to $50 (often $0 with prompt reporting)

- **Zero liability policies** from most credit card issuers

- **CCPA/GDPR rights** for data privacy violations

**Key point:** If breached AI app had read-only access, financial damage is limited—your bank accounts remain secure

## The Future of AI Financial Advisor Security

Emerging security enhancements for 2025 and beyond:

### 1. **Decentralized Finance (DeFi) Integration**

- Blockchain-based financial tracking

- User retains complete data ownership

- Zero-knowledge proofs (verify data without revealing it)

### 2. **Advanced Biometric Security**

- Facial recognition and fingerprint authentication becoming standard

- Behavioral biometrics (typing patterns, device usage)

- Continuous authentication (not just login, but ongoing verification)

### 3. **Privacy-Preserving AI**

- Federated learning (AI trains on your device, not central server)

- Differential privacy (mathematical guarantee of anonymization)

- Homomorphic encryption (AI analyzes encrypted data without decrypting)

### 4. **Regulatory Frameworks**

- Standardized security requirements for fintech

- Mandatory breach notification timelines

- Enhanced consumer data rights

## Conclusion: Balancing Convenience and Security

**AI financial advice IS safe when you:**

- Choose reputable, security-certified platforms

- Enable strong security practices (2FA, unique passwords)

- Understand what data you're sharing and how it's used

- Regularly monitor accounts and app permissions

- Stay informed about platform security practices

**The security benefits of AI financial advisors:**

- 60% reduction in fraud through real-time monitoring

- Bank-level encryption protecting your data

- Read-only access preventing unauthorized transactions

- Automated alerts catching issues early

**The bottom line:** For most people, using a reputable AI financial advisor is SAFER than manual financial tracking and often more secure than traditional advisory relationships.

**Ready to safely leverage AI for your financial future?**

[Start Securely with Compordo →](https://www.compordo.com)

---

*Have security questions about AI financial advisors? Join our [Discord community](https://discord.gg/wxRnk2Pmrt) where users discuss privacy practices and share security tips!*