Budgeting

How to Create a Budget in 2025: AI vs Manual Methods

By Compordo Team•January 18, 2025•10 min read

# How to Create a Budget in 2025: AI vs Manual Methods

Creating a budget is the foundation of financial success, but the methods available in 2025 are vastly different from just a few years ago. Should you stick with traditional manual budgeting, or embrace AI-powered automation? Let's explore both approaches.

## Why Budgeting Matters

Before diving into methods, let's understand why budgeting is crucial:

- **Financial Awareness**: Know exactly where your money goes

- **Goal Achievement**: Allocate funds toward your financial goals

- **Debt Reduction**: Pay off debts faster with strategic planning

- **Stress Reduction**: Eliminate money-related anxiety

- **Wealth Building**: Save and invest more effectively

## Method 1: Traditional Manual Budgeting

### The Classic Approach

Manual budgeting involves tracking income and expenses using spreadsheets, paper, or basic apps, and making decisions based on your analysis.

### Steps for Manual Budgeting:

1. **Calculate Your Income**

- List all income sources

- Use your after-tax (net) income

- Include side hustles and passive income

2. **Track Your Expenses**

- Review 2-3 months of bank statements

- Categorize every expense

- Identify patterns and trends

3. **Set Budget Categories**

- Housing (25-30% of income)

- Transportation (10-15%)

- Food (10-15%)

- Savings (20%+)

- Entertainment (5-10%)

- Other expenses

4. **Create Your Budget**

- Assign dollar amounts to each category

- Ensure expenses don't exceed income

- Allocate leftover funds to savings

5. **Monitor and Adjust**

- Review weekly or monthly

- Adjust as needed

- Stay disciplined

### Pros of Manual Budgeting:

✅ Complete control over every detail

✅ Deep understanding of your finances

✅ No technology dependency

✅ Free (using spreadsheets)

✅ Customizable to your needs

### Cons of Manual Budgeting:

❌ Time-consuming (2-3 hours/month)

❌ Prone to human error

❌ Requires discipline

❌ Delayed insights (not real-time)

❌ Easy to forget or procrastinate

## Method 2: AI-Powered Budgeting

### The Modern Approach

AI budgeting uses machine learning to automatically track, categorize, and analyze your spending, then creates optimized budgets based on your habits and goals.

### How AI Budgeting Works:

1. **Connect Your Accounts**

- Link bank accounts via secure platforms like Plaid

- One-time setup takes minutes

- AI monitors all transactions automatically

2. **Automatic Categorization**

- AI categorizes every transaction

- Learns from your corrections

- Handles complex transactions intelligently

3. **Smart Budget Creation**

- AI analyzes 2-3 months of spending

- Creates personalized budget recommendations

- Adjusts based on your goals

4. **Real-Time Monitoring**

- Track spending as it happens

- Get alerts when approaching limits

- See updated budget status instantly

5. **Intelligent Insights**

- AI identifies spending patterns

- Suggests savings opportunities

- Predicts future expenses

### Pros of AI Budgeting:

✅ Saves 2-3 hours monthly

✅ Real-time tracking and alerts

✅ Automatic categorization (99%+ accuracy)

✅ Predictive insights

✅ Reduces budgeting stress

✅ Never miss unusual spending

### Cons of AI Budgeting:

❌ Requires technology comfort

❌ Initial account connection needed

❌ Some services charge fees

❌ Privacy considerations (though secure)

## Head-to-Head Comparison

| Feature | Manual Budgeting | AI Budgeting |

|---------|-----------------|--------------|

| Time Required | 2-3 hours/month | 5-10 min/month |

| Accuracy | 80-90% | 99%+ |

| Real-Time Updates | No | Yes |

| Transaction Categorization | Manual | Automatic |

| Insights & Predictions | Limited | Advanced |

| Cost | Free | Free-$15/month |

| Learning Curve | Medium | Easy |

| Best For | Detail-oriented people | Busy professionals |

## The Hybrid Approach: Best of Both Worlds

You don't have to choose just one method. Many successful budgeters use a hybrid approach:

1. **Use AI for Daily Tracking**

- Automatic transaction monitoring

- Real-time spending alerts

- Quick budget check-ins

2. **Manual Review Monthly**

- Deep dive into spending patterns

- Adjust budget categories manually

- Set new financial goals

3. **Combine Insights**

- Use AI's data analysis

- Apply your personal judgment

- Make informed decisions

## Popular Budgeting Frameworks (Work with Both Methods)

### 50/30/20 Rule

- 50% Needs (housing, food, utilities)

- 30% Wants (entertainment, dining out)

- 20% Savings & debt repayment

### Zero-Based Budgeting

- Every dollar has a purpose

- Income minus expenses = $0

- No unallocated money

### Envelope System

- Cash allocated to categories

- When envelope is empty, stop spending

- Can be digital with AI budgeting

## How to Choose the Right Method for You

Choose **Manual Budgeting** if you:

- Enjoy detailed financial tracking

- Have 2-3 hours monthly to dedicate

- Prefer complete control

- Are uncomfortable with account linking

- Have simple finances

Choose **AI Budgeting** if you:

- Have a busy lifestyle

- Want real-time insights

- Prefer automation

- Have multiple accounts to track

- Want predictive analytics

- Are comfortable with technology

Choose **Hybrid** if you:

- Want automation with oversight

- Enjoy monthly financial reviews

- Want the best of both worlds

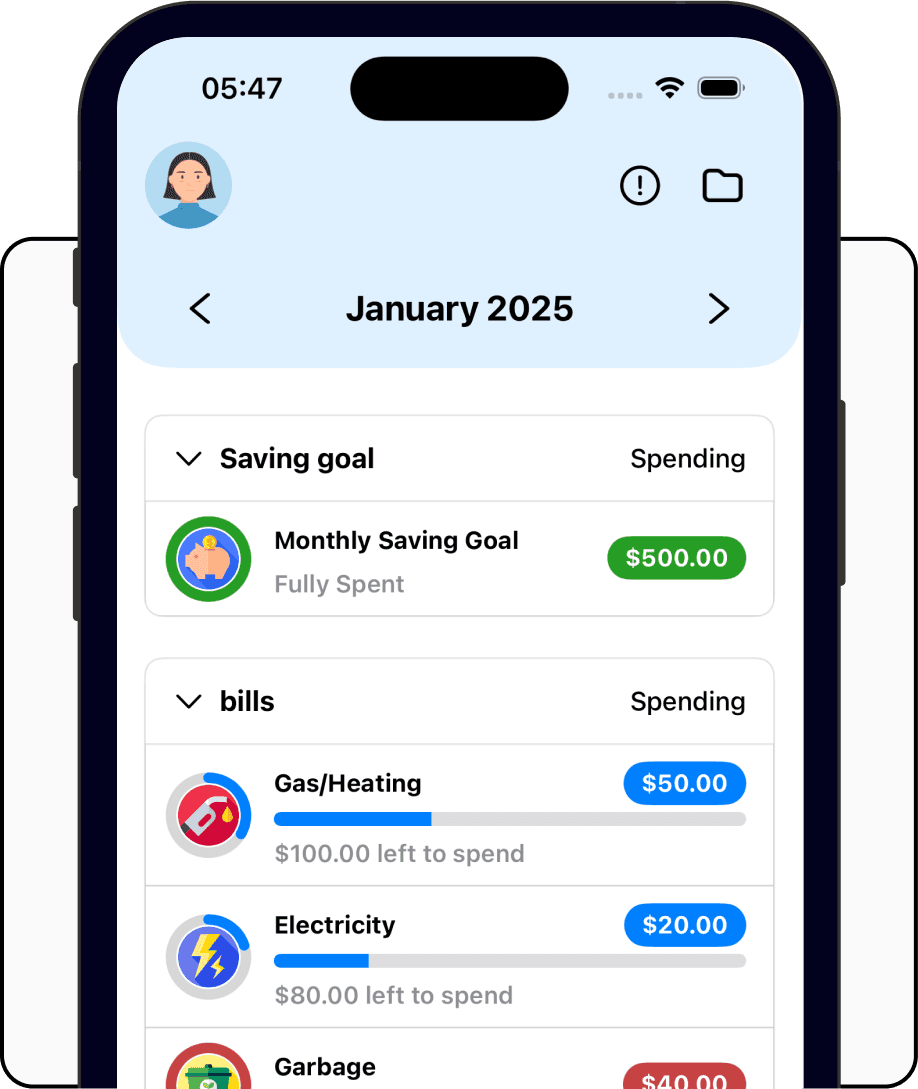

## Getting Started with Compordo's AI Budgeting

Compordo makes AI budgeting simple:

1. **Download the App** - Get started in under 2 minutes

2. **Connect Accounts** - Securely link via Plaid

3. **Let AI Work** - Automatic categorization begins

4. **Review Budget** - AI creates personalized recommendations

5. **Customize** - Adjust categories and amounts as needed

6. **Monitor** - Get real-time updates and insights

### Compordo's Unique Advantage

What makes Compordo different:

- **Flexibility**: Full AI automation OR manual control

- **Smart Learning**: AI improves with every transaction

- **Privacy First**: Bank-grade encryption

- **Free Lifetime Access**: Early adopters get it free forever

## Budget Creation Best Practices (Any Method)

1. **Be Realistic**: Don't set impossible targets

2. **Start Small**: Begin with major categories

3. **Review Regularly**: Weekly check-ins prevent overspending

4. **Adjust as Needed**: Life changes, budgets should too

5. **Celebrate Wins**: Acknowledge when you stay on track

6. **Learn from Mistakes**: Analyze overspending without judgment

## Common Budgeting Mistakes to Avoid

❌ **Forgetting Irregular Expenses**: Car maintenance, annual subscriptions

❌ **Too Restrictive**: Leaving no room for fun leads to burnout

❌ **Not Tracking Small Purchases**: $5 coffees add up

❌ **Setting and Forgetting**: Budgets need regular attention

❌ **Ignoring Savings**: Pay yourself first

❌ **Comparing to Others**: Your budget is personal

## The Future of Budgeting

Budgeting in 2025 and beyond will likely feature:

- More sophisticated AI predictions

- Voice-activated budget management

- Automatic bill negotiations

- Integrated investment advice

- Real-time financial coaching

## Conclusion

Both manual and AI budgeting have their place in 2025. The best method depends on your personality, lifestyle, and financial complexity.

For most people, AI budgeting offers the perfect balance of automation and control, saving time while providing superior insights. Apps like Compordo make it easier than ever to take control of your finances without sacrificing hours each month.

The most important thing? **Just start budgeting**. Whether you choose manual, AI, or hybrid, having any budget is infinitely better than having none.

Ready to experience effortless budgeting? Try Compordo's AI-powered platform and join thousands of users who've transformed their financial lives.

---

*Need help choosing the right budgeting method? Join our [Discord community](https://discord.gg/wxRnk2Pmrt) and get personalized advice!*