How-To Guide

How to Choose the Best AI Personal Financial Advisor: 2025 Complete Guide

By Compordo Team•January 22, 2025•9 min read

# How to Choose the Best AI Personal Financial Advisor: 2025 Complete Guide

Choosing the right **AI personal financial advisor** can transform your financial life—but with dozens of options available, how do you pick the best one? This comprehensive guide walks you through exactly what to look for when selecting an **AI personal financial advisor** that matches your needs.

## Why Choosing the Right AI Personal Financial Advisor Matters

The **AI personal financial advisor** you choose will:

- Manage your budget and track your spending

- Provide investment recommendations

- Help you achieve financial goals

- Access your sensitive financial data

Getting this choice right is crucial. The wrong **AI personal financial advisor** can:

- ❌ Provide poor advice

- ❌ Have security vulnerabilities

- ❌ Waste your money on unnecessary fees

- ❌ Miss important financial insights

## 10 Key Factors to Choose the Best AI Personal Financial Advisor

### 1. AI Technology & Intelligence Level

**What to Look For:**

The best **AI personal financial advisor** should use advanced machine learning that:

- ✅ **Learns from your behavior** - Adapts recommendations as it learns your habits

- ✅ **Provides predictive analytics** - Forecasts future expenses and trends

- ✅ **Offers personalized advice** - Not generic, one-size-fits-all tips

- ✅ **Explains its reasoning** - Shows why it recommends specific actions

**Red Flags:**

- ⚠️ "AI" that's just basic rules and automation

- ⚠️ Generic advice that doesn't adapt to you

- ⚠️ No explanation of how recommendations are generated

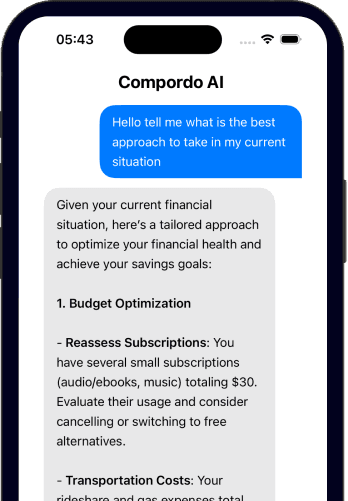

**Best Example**: Compordo uses advanced machine learning that continuously adapts to your unique financial situation, providing increasingly personalized recommendations.

---

### 2. Security & Data Protection

**What to Look For:**

Your **AI personal financial advisor** will access your most sensitive financial data. Ensure it has:

- ✅ **Bank-level encryption** (256-bit AES minimum)

- ✅ **Two-factor authentication** (2FA)

- ✅ **SOC 2 compliance** or equivalent security certification

- ✅ **Read-only access** to bank accounts (cannot move money)

- ✅ **Clear privacy policy** - No selling your data

**Questions to Ask:**

1. How is my data encrypted?

2. Where is data stored?

3. Who has access to my information?

4. Will my data be sold to third parties?

5. What happens to my data if I cancel?

**Red Flags:**

- ⚠️ Vague security descriptions

- ⚠️ No mention of encryption

- ⚠️ Privacy policy allows data selling

- ⚠️ No compliance certifications

---

### 3. Feature Set & Capabilities

**Essential Features Every AI Personal Financial Advisor Should Have:**

#### Budgeting:

- ✅ Automatic budget creation

- ✅ Real-time expense tracking

- ✅ Spending categorization

- ✅ Budget alerts and notifications

#### Investment Tracking:

- ✅ Portfolio monitoring

- ✅ Performance analytics

- ✅ Asset allocation insights

- ✅ Multiple account aggregation

#### Financial Planning:

- ✅ Goal setting and tracking

- ✅ Savings recommendations

- ✅ Debt payoff strategies

- ✅ Retirement planning tools

#### AI Capabilities:

- ✅ Personalized recommendations

- ✅ Predictive insights

- ✅ Natural language Q&A

- ✅ Automated financial management

**Comparison Checklist:**

| Feature | Must-Have | Nice-to-Have |

|---------|-----------|--------------|

| AI Budgeting | ✅ | |

| Investment Tracking | ✅ | |

| Goal Planning | ✅ | |

| Bill Tracking | | ✅ |

| Credit Score | | ✅ |

| Tax Optimization | | ✅ |

---

### 4. Cost & Value

**Pricing Models for AI Personal Financial Advisors:**

1. **Free with Ads** (e.g., Mint)

- Pro: No cost

- Con: Ads, limited features, data may be sold

2. **Freemium** (Free basic, paid premium)

- Pro: Try before you buy

- Con: Important features often locked

3. **Subscription** (Monthly/Annual fee)

- Pro: Full features, no ads

- Con: Ongoing cost

4. **One-Time Payment**

- Pro: Pay once, use forever

- Con: May lack updates

**What's Fair Pricing?**

- **$0-5/month**: Basic features, good for beginners

- **$5-15/month**: Premium AI personal financial advisor with advanced features

- **$15+/month**: Should include investment management and advisory

**Value Assessment Formula:**

Calculate potential savings from the **AI personal financial advisor**:

- Better budgeting savings: $200-500/month

- Investment fee savings vs. human advisor: $100-1,000/month

- Late fee prevention: $20-50/month

If monthly savings > subscription cost, it's worth it!

---

### 5. Ease of Use & User Experience

**What Makes a Great User Experience:**

- ✅ **Intuitive interface** - Find features without hunting

- ✅ **Quick setup** - Running in under 10 minutes

- ✅ **Mobile & web apps** - Access anywhere

- ✅ **Clean dashboard** - See financial health at a glance

- ✅ **Minimal clicks** - Complete tasks efficiently

**Test Before Committing:**

1. How long does setup take?

2. Can you find key features easily?

3. Is the dashboard overwhelming or clear?

4. How many clicks to complete common tasks?

5. Does it work smoothly on mobile?

**Red Flags:**

- ⚠️ Confusing navigation

- ⚠️ Slow, buggy performance

- ⚠️ Mobile app is an afterthought

- ⚠️ Information overload

---

### 6. Account Integration & Connectivity

**What to Check:**

The best **AI personal financial advisor** should connect to:

- ✅ **All major banks** (Chase, Bank of America, Wells Fargo, etc.)

- ✅ **Credit cards** (Visa, Mastercard, Amex, etc.)

- ✅ **Investment accounts** (Fidelity, Vanguard, Robinhood, etc.)

- ✅ **Cryptocurrency exchanges** (Coinbase, Binance, etc.)

- ✅ **Other financial accounts** (PayPal, Venmo, etc.)

**Connection Methods:**

1. **Automatic (via Plaid/MX)** - Best option, most secure

2. **Manual CSV import** - Backup option if auto fails

3. **Manual entry** - Last resort

**Questions to Ask:**

- Does it support MY specific bank/broker?

- How often does it sync (real-time vs. daily)?

- What if an account doesn't connect?

- Can I manually add accounts?

---

### 7. Customer Support Quality

**Support Channels to Look For:**

- ✅ **Live chat** - Immediate help

- ✅ **Email support** - For non-urgent issues

- ✅ **Phone support** - For complex problems

- ✅ **Help center/KB** - Self-service answers

- ✅ **Community forum** - Learn from other users

**Testing Support Quality:**

1. Send a pre-sale question

2. Check response time

3. Evaluate helpfulness

4. Read reviews about support experiences

**Red Flags:**

- ⚠️ No clear contact method

- ⚠️ Takes days to respond

- ⚠️ Generic, unhelpful answers

- ⚠️ No phone support option

---

### 8. Reviews & Reputation

**Where to Check Reviews:**

- 📱 **App Store / Google Play** - Real user experiences

- ⭐ **Trustpilot** - Verified customer reviews

- 💬 **Reddit** (r/personalfinance) - Honest opinions

- 📰 **Tech review sites** - Expert analysis

- 🗣️ **Social media** - Current user sentiment

**What to Look For in Reviews:**

- ✅ 4+ star average rating

- ✅ Many recent reviews (app is active)

- ✅ Specific praise about AI features

- ✅ Developer responds to issues

- ✅ Positive trend over time

**Red Flags in Reviews:**

- ⚠️ Security concerns mentioned

- ⚠️ Sync issues not being fixed

- ⚠️ Bait-and-switch pricing

- ⚠️ Poor customer service stories

---

### 9. Company Stability & Track Record

**Why This Matters:**

You're trusting this company with your financial data long-term. Check:

- ✅ **How long has it been in business?**

- 5+ years = proven track record

- 1-2 years = newer, more risk

- ✅ **Is it venture-backed or profitable?**

- Profitable = sustainable

- VC-backed = could pivot or shut down

- ✅ **Any security breaches in the past?**

- None = good

- Breach but handled well = acceptable

- Breach covered up = red flag

- ✅ **Regular updates and improvements?**

- Monthly = active development

- Yearly or less = stagnant

---

### 10. Free Trial or Money-Back Guarantee

**Before Fully Committing:**

The best **AI personal financial advisor** will offer:

- ✅ **Free trial** (7-30 days) - Test all features

- ✅ **Freemium tier** - Use basic features free forever

- ✅ **Money-back guarantee** (30-60 days) - Risk-free trial

**What to Test During Trial:**

1. Connect your accounts (do they all work?)

2. Use AI features (how helpful are recommendations?)

3. Navigate the interface (is it easy?)

4. Contact support (are they responsive?)

5. Check mobile app (does it work well?)

**Red Flags:**

- ⚠️ No way to try before buying

- ⚠️ Credit card required for "free" trial

- ⚠️ Hard to cancel

---

## Step-by-Step: How to Choose Your AI Personal Financial Advisor

### Step 1: Assess Your Needs

- What's your primary goal? (Budgeting, investing, both?)

- How tech-savvy are you?

- What's your budget for a financial advisor?

- How complex is your financial situation?

### Step 2: Create Your Shortlist

Based on your needs, shortlist 3-5 **AI personal financial advisors** that seem promising.

### Step 3: Check Security

Verify each option has bank-level security and good privacy practices.

### Step 4: Compare Features

Create a spreadsheet comparing features you need across your shortlist.

### Step 5: Read Reviews

Spend 15 minutes reading recent reviews for each option.

### Step 6: Test Free Trials

Sign up for free trials of your top 2-3 choices.

### Step 7: Make Your Decision

After testing, choose the **AI personal financial advisor** that:

- Feels most intuitive

- Has the features you need

- Fits your budget

- Gives you confidence

---

## Top AI Personal Financial Advisors Compared

### Compordo - Best Overall

✅ Advanced AI technology

✅ Comprehensive budgeting & investment features

✅ Excellent security

✅ Great value for money

✅ Intuitive interface

### Mint - Best Free Option

✅ Completely free

✅ Good basic budgeting

⚠️ Limited AI features

⚠️ Lots of ads

### YNAB - Best for Strict Budgeting

✅ Proven budgeting methodology

✅ Good educational content

⚠️ Expensive ($14.99/month)

⚠️ No investment tracking

---

## Common Mistakes to Avoid

### 1. Choosing Based on Price Alone

The cheapest isn't always best. Consider value, not just cost.

### 2. Ignoring Security

Don't compromise on security to save a few dollars.

### 3. Not Testing First

Always use a free trial before committing.

### 4. Overlooking Mobile Experience

You'll use your phone most - make sure the app is great.

### 5. Assuming "AI" Means Advanced

Many apps claim AI but only offer basic automation.

---

## Conclusion: Make the Right Choice

Choosing the best **AI personal financial advisor** comes down to:

1. **Security first** - Never compromise on this

2. **Features you'll actually use** - More isn't always better

3. **Ease of use** - You won't use it if it's complicated

4. **Fair pricing** - Balance cost with value

5. **Good support** - You'll need help sometimes

For most people in 2025, **Compordo** offers the best combination of advanced AI technology, comprehensive features, strong security, and excellent value.

Ready to take control of your finances? [Try Compordo free](https://www.compordo.com) and experience the best **AI personal financial advisor** for yourself.

---

*Still have questions about choosing an AI personal financial advisor? Join our [Discord community](https://discord.gg/wxRnk2Pmrt) for personalized guidance!*