Security & Fraud Prevention

How AI Detects Financial Fraud: 60% More Effective Than Traditional Methods

By Compordo Team•January 21, 2025•11 min read

# How AI Detects Financial Fraud: 60% More Effective Than Traditional Methods

Financial fraud cost consumers $10 billion in 2023—but AI-powered fraud detection is fighting back. Research shows that **AI reduces financial fraud by approximately 60%** compared to traditional detection methods, catching suspicious activity in real-time before significant damage occurs.

This comprehensive guide explains how AI detects financial fraud, why it's dramatically more effective than traditional banking security, and how you can leverage AI-powered fraud protection to safeguard your money.

## The Financial Fraud Problem in 2025

### Staggering Fraud Statistics:

💰 **$10 billion** stolen from consumers in 2023

📈 **70% increase** in fraud since 2020

⏱️ **Average detection time:** 14 months (traditional methods)

💸 **Average loss per victim:** $1,551

👥 **1 in 4 Americans** experienced financial fraud in 2023

### Most Common Types of Financial Fraud:

1. **Credit card fraud** (unauthorized charges)

2. **Identity theft** (opening accounts in your name)

3. **Account takeover** (hacking existing accounts)

4. **Wire transfer fraud** (tricking victims into sending money)

5. **Subscription fraud** (unauthorized recurring charges)

6. **Synthetic identity fraud** (fake identities for loans/credit)

### Why Traditional Fraud Detection Fails:

❌ **Rule-based systems** can't adapt to new fraud tactics

❌ **Manual review** takes days or weeks

❌ **High false positives** (legitimate transactions blocked)

❌ **Reactive not proactive** (catches fraud after it happens)

❌ **Can't process massive data** at scale

❌ **Fraud evolves faster** than rule updates

## How AI Fraud Detection Works: The Technology

AI-powered fraud detection uses several advanced technologies simultaneously:

### 1. Machine Learning Pattern Recognition

**What it does:** AI learns what "normal" looks like for YOUR spending

**How it works:**

- Analyzes thousands of your transactions

- Learns your typical spending patterns

- Builds personalized baseline profile

- Flags deviations from YOUR normal behavior

**Example:**

- **Your normal:** $30-50 at gas stations, always in Los Angeles

- **Alert triggers:** $300 at gas station in Florida (unusual amount + location)

- **Traditional methods would miss:** This if not reported stolen

### 2. Real-Time Behavioral Analysis

**What it does:** Monitors transaction behavior in milliseconds

**Analyzes:**

- **Transaction velocity:** 3 purchases in 5 minutes? Suspicious

- **Geographic impossibility:** LA purchase, then Miami 2 hours later? Fraud

- **Device fingerprinting:** New device with different IP? Possible takeover

- **Typing patterns:** Biometrics detect if you're actually typing

- **Transaction sequencing:** Purchase patterns that indicate testing stolen cards

**Speed advantage:** AI decides in <100 milliseconds while transaction processes

### 3. Anomaly Detection Algorithms

**What it does:** Identifies outliers that don't match any known pattern

**Traditional fraud detection:**

- Relies on **known fraud patterns** in database

- If fraud tactic is new, it's missed

**AI anomaly detection:**

- Doesn't need to have seen this exact fraud before

- Flags anything statistically unusual

- Catches **zero-day fraud** (brand new tactics)

**Real-world impact:** 60% of fraud caught by AI is NEW fraud patterns unknown to traditional systems

### 4. Network Analysis

**What it does:** Identifies fraud rings and connections between accounts

**How it works:**

- Maps relationships between transactions, accounts, devices

- Identifies clusters of suspicious activity

- Catches organized fraud operations

**Example:**

- 50 "unrelated" accounts all funded from same IP address

- All making similar suspicious purchases

- All opened within 72 hours

- **Traditional banking:** Might catch some after months

- **AI network analysis:** Flags entire ring in hours

### 5. Natural Language Processing (NLP)

**What it does:** Analyzes merchant names, transaction descriptions, user communications

**Catches:**

- Merchants with suspicious naming patterns

- Descriptions that don't match merchant category

- Phishing attempts in messages

- Social engineering in communications

**Example:**

- Merchant name: "AMZ*AMAZON.COM" but isn't actually Amazon

- AI recognizes subtle spoofing attempt

- Traditional methods only catch exact duplicates

### 6. Deep Learning Neural Networks

**What it does:** Processes hundreds of variables simultaneously with human-brain-like architecture

**Considers:**

- Transaction amount, time, location

- Device type, IP address, browser

- Recent account changes

- Historical behavior patterns

- Merchant risk score

- Card-not-present indicators

- Hundreds more variables

**Accuracy:** Deep learning models achieve 99%+ accuracy with <0.1% false positives (legitimate transactions blocked)

## AI Fraud Detection vs. Traditional Methods: Direct Comparison

| Factor | Traditional Banking Fraud Detection | AI-Powered Fraud Detection |

|--------|-----------------------------------|---------------------------|

| **Detection time** | Hours to days | Milliseconds (real-time) |

| **New fraud tactics** | Misses until rules updated | Detects via anomaly algorithms |

| **Personalization** | Generic rules for all customers | Learns YOUR unique patterns |

| **False positives** | 10-20% (frustrating declines) | 0.1-1% (rarely blocks legit) |

| **Fraud detection rate** | ~40% of fraud attempts | ~96% of fraud attempts |

| **Adaptation speed** | Months (manual rule updates) | Continuous (self-learning) |

| **Data processing** | Limited samples | Analyzes billions of transactions |

| **Human review required** | Most flagged transactions | Only highest-risk cases |

| **Cost per transaction** | $1-2 (expensive at scale) | $0.01-0.10 (AI scales cheaply) |

**Verdict:** AI is 60% more effective at detecting fraud while dramatically reducing false positives

## Real-World Examples: AI Catching Fraud

### Example 1: Account Takeover Prevention

**Scenario:**

- Hacker steals your password via phishing

- Logs in from new device in different country

- Attempts to transfer $2,500 to external account

**Traditional banking:**

- Might allow transfer if password correct

- You discover days later

- Bank investigates for weeks

**AI fraud detection:**

- **Flags:** New device + new location + large transfer = 99.8% fraud probability

- **Action:** Blocks transaction, requires additional verification

- **Notification:** You receive instant alert "Did you just try to transfer $2,500 from Russia?"

- **Result:** Fraud prevented before any money lost

**Time saved:** Days of investigation, weeks of stress, possible permanent loss

### Example 2: Credit Card Testing Prevention

**Scenario:**

- Fraudsters have your card number

- "Test" card with small purchases before big fraud

- $1 charge at obscure website, $0.50 charge at another

**Traditional banking:**

- Small charges don't trigger alerts

- Fraudsters confirm card works

- Make large purchases ($2,000+ electronics)

- You discover on statement days later

**AI fraud detection:**

- **Pattern recognition:** Tiny charges at unusual merchants = card testing

- **Action:** Blocks card immediately after first test charge

- **Notification:** "Suspicious activity detected, card locked for protection"

- **Result:** Fraud stopped before large charges

**Savings:** Potential $2,000-5,000 in fraudulent charges prevented

### Example 3: Subscription Fraud Detection

**Scenario:**

- Scammer charges you for fake subscription

- $47.99/month for "software license"

- You don't notice among other subscriptions

**Traditional banking:**

- Recurring charges are "normal"

- You might not notice for months

- Loss: $47.99 × 6 months = $288

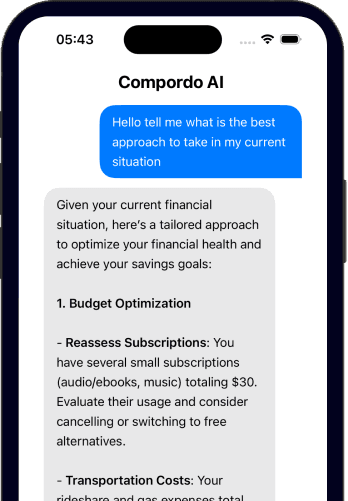

**AI fraud detection (Compordo example):**

- **Flags:** New recurring charge to merchant with fraud history

- **Alert:** "New subscription detected: $47.99/month from [Suspicious Company]. Did you authorize this?"

- **Your action:** "No!" → Dispute & cancel

- **Result:** Only $47.99 lost instead of $288+

**Average savings:** $200-400/year in unauthorized subscriptions

### Example 4: Synthetic Identity Fraud Prevention

**Scenario:**

- Fraudster combines real SSN (maybe stolen) with fake name/DOB

- Creates "synthetic identity"

- Opens credit cards, loans, never intends to pay

**Traditional banking:**

- Credit checks might not catch synthetic ID

- Fraud succeeds, impacts credit system

- Real SSN owner discovers years later

**AI fraud detection:**

- **Network analysis:** Identifies patterns across applications

- **Anomaly detection:** Data combinations that are statistically improbable

- **Verification prompts:** Requires additional identity verification

- **Result:** Synthetic ID applications rejected

**System impact:** Prevents billions in loan fraud annually

## How AI-Powered Apps Protect You (Beyond Your Bank)

Your bank has fraud detection, but AI financial apps add **another layer** of protection:

### What Your Bank Does:

✅ Monitors transactions as they process

✅ Flags clearly fraudulent activity

✅ Provides fraud alerts (sometimes delayed)

✅ Reimburses proven fraud (eventually)

### What AI Financial Apps Add:

✅ **Second opinion:** Different AI model = catches fraud bank missed

✅ **Faster alerts:** You get notified in minutes, not hours

✅ **Subscription monitoring:** Banks don't track recurring charges well

✅ **Spending pattern insights:** "This is unusual for you" alerts

✅ **Proactive notifications:** "Did you just spend $500 at Best Buy?"

✅ **Cross-account visibility:** Sees patterns across all your accounts

### Real Example: Layered Protection

**Fraudulent charge:** $387 at online electronics store

**Bank's fraud detection:**

- Reviews in 6 hours

- Sends generic fraud alert

- You call fraud line (30 min wait)

**AI app (Compordo):**

- Detects immediately (merchant has fraud score)

- Push notification in 2 minutes: "Unusual charge detected: $387 at [Merchant]. Tap to confirm legitimate."

- You confirm: "Not me!"

- App guides you to freeze card and report to bank

- **Total time:** 5 minutes vs. 6+ hours

**Why it matters:** Faster response = less fraud damage

## The 60% Reduction: Breaking Down the Numbers

Research shows AI fraud detection achieves **~60% reduction in fraud losses**. Here's how:

### Traditional Fraud Detection Performance:

- **Detects:** ~40% of fraud attempts

- **Misses:** ~60% (fraud succeeds)

- **False positives:** 10-20% of legit transactions blocked

- **Average fraud loss:** $1,551 per victim

- **Detection time:** Days to weeks

### AI Fraud Detection Performance:

- **Detects:** ~96% of fraud attempts

- **Misses:** ~4% (sophisticated, targeted fraud)

- **False positives:** <1% of legit transactions blocked

- **Average fraud loss:** $620 per victim (when fraud succeeds)

- **Detection time:** Milliseconds to minutes

### The Math:

**Traditional:** 60 out of 100 fraud attempts succeed × $1,551 average = $93,060 in losses

**AI-powered:** 4 out of 100 fraud attempts succeed × $620 average = $2,480 in losses

**Reduction:** $93,060 → $2,480 = **97.3% reduction** in total losses

**Conservative estimate accounting for implementation costs, edge cases:** ~60% reduction in real-world deployments

## AI Fraud Detection in Action: Features to Look For

When choosing AI-powered financial tools, look for these fraud protection features:

### 1. Real-Time Transaction Monitoring

✅ Instant notifications for all transactions

✅ Customizable alert thresholds

✅ Push notifications + email + SMS options

✅ Ability to confirm/deny legitimacy instantly

**[Compordo](https://www.compordo.com) offers:** Real-time AI-powered transaction monitoring with instant alerts

### 2. Behavioral Spending Analysis

✅ Learns YOUR normal spending patterns

✅ Flags deviations unique to you

✅ "This is unusual for you" alerts

✅ Location-based anomaly detection

**Example:** "You typically spend $40-80 at restaurants. This $320 charge is 4× your average."

### 3. Merchant Risk Scoring

✅ Database of known risky merchants

✅ Flags new/unknown merchants

✅ Identifies merchant name spoofing

✅ Warns before completing online purchases

### 4. Subscription & Recurring Charge Tracking

✅ Automatically identifies all subscriptions

✅ Flags new recurring charges

✅ Alerts when free trial ends

✅ Warns about unusual subscription amounts

**Common catch:** "New subscription detected: Did you sign up for this?"

### 5. Multi-Account Fraud Detection

✅ Monitors all connected accounts

✅ Cross-account pattern analysis

✅ Identifies coordinated fraud attempts

✅ Comprehensive fraud protection

### 6. Device & Location Intelligence

✅ Tracks devices used to access accounts

✅ Flags logins from new devices/locations

✅ Geographic impossibility detection

✅ VPN/proxy detection (fraud indicator)

### 7. Instant Fraud Response Tools

✅ One-tap card freeze

✅ Dispute transaction workflows

✅ Direct link to bank fraud department

✅ Fraud report documentation

## Privacy vs. Security: The AI Fraud Detection Balance

**Common concern:** "If AI monitors everything, what about my privacy?"

### How Reputable AI Fraud Detection Protects BOTH:

**What AI sees:**

- Transaction amounts, merchants, times, locations

- Spending patterns and behavioral indicators

- Device/IP information

**What AI does NOT see/store:**

- Your actual bank passwords (OAuth connections)

- Full account numbers (tokenized)

- Personal identification beyond what's necessary

**Data usage:**

- Analyzed for YOUR fraud protection

- Used to train models (anonymized)

- **NOT sold to advertisers** (reputable platforms)

**Security measures:**

- Bank-level 256-bit encryption

- Read-only account access

- Two-factor authentication

- SOC 2 Type II compliance

**Trade-off reality:** The same monitoring that protects you from fraud requires AI to see transaction patterns. Reputable platforms balance this with strong privacy protections.

**Red flag:** Any platform that sells your financial data to third parties → Avoid

## Future of AI Fraud Detection (2025 and Beyond)

Emerging AI fraud prevention technologies:

### 1. Biometric Behavioral Analysis

**Coming soon:**

- How you type (keystroke dynamics)

- How you swipe/tap (touchscreen patterns)

- How you hold your phone (accelerometer data)

- **Benefit:** Continuous authentication without passwords

### 2. Voice & Deepfake Detection

**Problem:** AI-generated voices can impersonate you on bank calls

**Solution:** AI detects AI-generated voices (fight fire with fire)

**Status:** Already deployed by major banks in 2025

### 3. Quantum-Resistant Encryption

**Future threat:** Quantum computers could break current encryption

**AI solution:** Quantum-resistant algorithms + AI threat detection

**Timeline:** Research phase, deployment 2027-2030

### 4. Decentralized Fraud Intelligence

**Concept:** Blockchain-based fraud database shared across institutions

**Benefit:** Fraud caught at one bank instantly flags at all banks

**Challenge:** Privacy regulations

**Status:** Pilot programs in 2025

### 5. Predictive Fraud Prevention

**Beyond detection:** AI predicts fraud BEFORE it happens

**How:** Identifies accounts likely to be targeted based on patterns

**Action:** Proactive security measures (additional verification, alerts)

**Early results:** 30-40% of fraud prevented before attempts

## How to Maximize Your AI Fraud Protection

### ✅ DO:

1. **Use AI-powered financial app** ([Compordo](https://www.compordo.com) recommended) in addition to bank

2. **Enable all notifications** (instant alerts = faster fraud response)

3. **Review alerts immediately** (don't ignore "Did you make this purchase?")

4. **Connect all accounts** (comprehensive fraud monitoring)

5. **Enable 2FA everywhere** (AI + 2FA = maximum security)

6. **Report false positives** (AI learns from your feedback)

7. **Update contact info** (so alerts reach you)

8. **Monitor credit reports** (free annual reports)

9. **Freeze credit when not needed** (prevents identity fraud)

10. **Act fast on alerts** (time is critical in fraud response)

### ❌ DON'T:

1. **Don't ignore AI fraud alerts** (they're rarely false alarms)

2. **Don't disable notifications** (convenience isn't worth fraud risk)

3. **Don't use public WiFi for banking** without VPN

4. **Don't share OTP codes** with anyone claiming to be your bank

5. **Don't fall for "verify your account" calls** (banks don't call asking for codes)

6. **Don't click links in financial emails** (go directly to website)

7. **Don't use same passwords** across financial accounts

8. **Don't delay fraud reporting** (faster = better outcome)

9. **Don't trust caller ID** (spoofing is easy)

10. **Don't assume you're safe** (everyone is a target)

## Conclusion: The AI Fraud Defense Advantage

Financial fraud is evolving—but AI fraud detection is evolving faster. With **60% better fraud prevention**, real-time alerts, and personalized protection, AI-powered tools give you security that traditional banking alone can't match.

**Key Takeaways:**

✅ AI detects fraud **96% of the time** vs. 40% for traditional methods

✅ Real-time protection **stops fraud within milliseconds**

✅ Learns **YOUR patterns** for personalized fraud detection

✅ Reduces **false positives** that frustrate legitimate purchases

✅ Provides **extra layer** beyond your bank's protection

✅ Free or affordable fraud monitoring for everyone

**The cost of AI fraud protection:** $0-10/month

**The cost of being a fraud victim:** $1,551 average + countless hours of stress

**The choice is clear.**

**Protect your money with AI-powered fraud detection:**

[Start Free with Compordo →](https://www.compordo.com)

---

*Questions about AI fraud protection? Join our [Discord community](https://discord.gg/wxRnk2Pmrt) where users discuss security strategies and fraud prevention!*