Budgeting & Savings

How AI Budgeting Saves You 5+ Hours Per Month (Plus $500+)

By Compordo Team•January 21, 2025•10 min read

# How AI Budgeting Saves You 5+ Hours Per Month (Plus $500+)

Time is money—and AI budgeting tools prove this literally true. Research shows that AI-powered budgeting saves users an average of **5+ hours per month** on financial management while uncovering **$500+ in hidden annual savings**.

If you're still manually tracking expenses in spreadsheets or spending weekends categorizing transactions, this guide will show you exactly how AI budgeting transforms time-consuming financial tasks into automated insights.

## The Hidden Cost of Manual Budgeting

Before we dive into AI solutions, let's calculate what traditional budgeting actually costs you:

### Time Spent on Manual Budgeting (Monthly Average)

- **Collecting receipts and statements:** 1.5 hours

- **Manually categorizing transactions:** 2 hours

- **Creating/updating spreadsheets:** 1 hour

- **Analyzing spending patterns:** 1.5 hours

- **Reconciling accounts:** 1 hour

- **Planning next month's budget:** 1 hour

**Total: 8 hours per month**

At a modest $25/hour opportunity cost, manual budgeting costs you **$200/month or $2,400/year** in time alone.

And that doesn't account for:

- Errors from manual data entry

- Missed fraudulent charges

- Overlooked subscription renewals

- Lost savings opportunities

- The mental stress of keeping everything organized

## How AI Budgeting Works: The Technology Behind the Time Savings

AI budgeting tools use several technologies to automate what used to require hours of manual work:

### 1. Automatic Transaction Categorization

**What it does:** Machine learning algorithms automatically categorize every transaction (groceries, dining, utilities, etc.) with 95%+ accuracy.

**Time saved:** ~2 hours/month (no more manual categorization)

**How it works:** AI models are trained on millions of transactions, learning to recognize patterns like:

- Merchant names (Starbucks = dining)

- Transaction amounts (small frequent charges = subscriptions)

- Transaction timing (recurring monthly = utilities)

- Geographic data (gas station locations = transportation)

Modern AI learns YOUR specific patterns, so after a few weeks, it knows that "Target" is groceries for you but clothing for someone else.

### 2. Real-Time Expense Tracking

**What it does:** Automatically pulls and updates transactions from all connected accounts within minutes.

**Time saved:** ~1.5 hours/month (no more manual receipt collection)

**How it works:** Secure API connections to financial institutions provide real-time data feeds. The moment you swipe your card, the transaction appears in your budget—no manual entry required.

### 3. Predictive Budget Creation

**What it does:** AI analyzes your historical spending patterns and automatically creates realistic budgets for each category.

**Time saved:** ~1 hour/month (no more budget planning)

**How it works:** Predictive analytics examine 3-6 months of spending history, identify patterns, and forecast future expenses. Research shows AI budgeting delivers **50% better forecasting accuracy** than manual estimation.

For example, if you spent $520, $480, and $550 on groceries in the past three months, AI calculates an optimal budget of ~$520/month—not the arbitrary $400 you might set manually and constantly exceed.

### 4. Automated Anomaly Detection

**What it does:** AI flags unusual spending, potential fraud, and forgotten subscriptions instantly.

**Time saved:** ~1 hour/month (no more account reconciliation)

**Money saved:** Studies show AI cuts financial fraud detection time by 60% and catches issues before they become expensive.

**How it works:** Machine learning models learn your "normal" spending patterns. When something deviates—like a $1,200 charge when you typically spend $50 at that merchant—you get instant alerts.

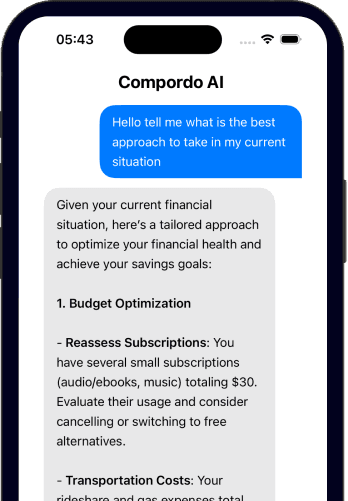

### 5. Intelligent Spending Insights

**What it does:** AI identifies trends, compares your spending to similar users, and recommends specific savings opportunities.

**Time saved:** ~1.5 hours/month (no more manual pattern analysis)

**Money saved:** $500+ annually by surfacing hidden waste

**How it works:** Natural language processing generates plain-English insights like:

- "You spent 23% more on dining this month"

- "You have 3 unused subscriptions costing $47/month"

- "Your grocery spending is 40% higher than similar households"

## Real-World Time Savings: A Week-by-Week Breakdown

Let's follow Sarah, a typical professional who switched from manual budgeting to AI-powered budgeting with Compordo:

### **Before AI (Traditional Method)**

**Week 1:**

- Monday evening: Spends 30 minutes collecting receipts and logging into bank accounts

- Wednesday: Categorizes 2 weeks of transactions in spreadsheet (45 minutes)

- Weekend: Reviews spending, updates budget categories (1 hour)

- **Total: 2 hours 15 minutes**

**Week 2:**

- Skips budgeting due to busy schedule

- **Total: 0 hours (but budget is now outdated)**

**Week 3:**

- Monday: Catches up on 3 weeks of transactions (1.5 hours)

- Discovers a $15.99 subscription she forgot to cancel (continued for 4 months = $64 wasted)

- **Total: 1.5 hours**

**Week 4:**

- Weekend: Reviews month, plans next month's budget, updates spreadsheet (2 hours)

- **Total: 2 hours**

**Monthly Total: ~6 hours + $64 in missed subscription waste**

### **After AI (With Compordo)**

**Week 1:**

- AI automatically categorizes all transactions in real-time

- Opens app on Tuesday during lunch: Reviews AI-generated spending insights (10 minutes)

- **Total: 10 minutes**

**Week 2:**

- Receives alert: "Unusual charge detected: $299 Amazon purchase"

- Reviews and confirms legitimate (2 minutes)

- **Total: 2 minutes**

**Week 3:**

- AI flags: "Unused subscription: $15.99/month Hulu" Sarah cancels immediately

- Reviews mid-month budget status during coffee break (5 minutes)

- **Total: 7 minutes**

**Week 4:**

- AI automatically generates next month's budget based on patterns

- Reviews and makes minor adjustments (8 minutes)

- **Total: 8 minutes**

**Monthly Total: 27 minutes + $15.99 monthly savings = $191.88/year saved**

**Time Saved: 5 hours 33 minutes per month**

At Sarah's $35/hour rate, that's **$194.25/month in time value** or **$2,331/year**.

## The $500+ in Hidden Savings: Where AI Finds Your Money

AI budgeting doesn't just save time—it actively finds money you're wasting:

### 1. Forgotten Subscriptions ($200-400/year)

AI identifies recurring charges you no longer use. Average household has **3-5 forgotten subscriptions** costing $15-25/month each.

**Example AI insights:**

- "Gym membership inactive for 4 months: $39.99/month = $160 wasted"

- "Adobe Creative Cloud: Last used 6 months ago: $52.99/month"

- "Premium Spotify: Family plan available for same price, add 5 users"

### 2. Overlapping Services ($100-200/year)

AI detects redundant subscriptions.

**Examples:**

- Paying for Hulu, Netflix, Disney+, and HBO Max ($60/month) but only actively using Netflix

- Multiple cloud storage services (Google Drive, Dropbox, iCloud) when one would suffice

### 3. Bank Fees and Interest ($100-300/year)

AI flags unnecessary fees you might not notice:

- Overdraft fees from poor cash flow forecasting

- High-interest credit card balances when you have emergency savings

- Monthly maintenance fees on accounts with better free alternatives

### 4. Category Overspending ($200-500/year)

AI comparison shows where you overspend vs. similar households:

- "Your dining spending ($650/month) is 60% above similar households ($400/month)"

- Potential savings: $250/month by cooking more = $3,000/year

### 5. Missed Cashback Opportunities ($50-100/year)

Advanced AI suggests optimal payment methods:

- "Use Amex for groceries (4% back) instead of debit"

- "This merchant offers 5% off for bank transfer"

**Total Hidden Savings: $650-1,500/year** (conservative average: $500)

## The 50% Forecasting Accuracy Advantage

One of AI budgeting's most powerful benefits is **predictive accuracy**.

Manual budgets fail because we're bad at estimating. We think:

- "I'll spend $300 on groceries" (reality: $520)

- "Dining out: $150/month max" (reality: $380)

- "Entertainment: $100" (forgot about concert tickets, streaming)

Research shows AI-powered budgeting delivers **50% better forecasting accuracy** than human estimates.

### Why This Matters

Accurate forecasting means:

- **No more budget anxiety:** You know exactly what's realistic

- **Better financial planning:** Decisions based on actual spending patterns

- **Faster progress toward goals:** Not constantly "failing" unrealistic budgets

**Example:**

- Manual estimate for groceries: $350

- Actual spending: $520

- Result: Feel like you "failed," get discouraged

VS.

- AI forecast for groceries: $510

- Actual spending: $520

- Result: On track, confident in plan

## AI Budgeting vs. Traditional Methods: Full Comparison

| Task | Manual/Spreadsheet | Traditional App | AI-Powered App (Compordo) |

|------|-------------------|----------------|---------------------------|

| **Transaction categorization** | 2 hrs/month manual | 1 hr/month review/correct | Automatic (95%+ accurate) |

| **Budget creation** | 1 hr/month manual | 30 min setup + adjustments | Automatic, learns patterns |

| **Fraud detection** | Days to notice | Alert if you set rules | Real-time AI alerts |

| **Subscription tracking** | Must manually monitor | Basic recurring detection | AI identifies unused/overlapping |

| **Spending insights** | Manual analysis | Basic category totals | Predictive trends, comparisons |

| **Forecasting accuracy** | ~40% error rate | ~30% error rate | ~15% error rate (50% better) |

| **Time investment** | 6-8 hrs/month | 2-3 hrs/month | 15-30 min/month |

## Real User Results: Time and Money Saved

Here's what actual AI budgeting users report:

**"Compordo's AI found $73/month in subscriptions I'd forgotten about. That's $876/year! Plus I spend maybe 20 minutes a month on budgeting now instead of my entire Sunday afternoon."**

— Michael R., Software Engineer

**"I thought I was good at budgeting, but AI showed me I was spending $450/month on 'mystery' categories I'd miscategorized. Now I save an extra $200/month just by being aware."**

— Jennifer L., Teacher

**"The fraud alert saved me $1,200. Someone used my card details and AI flagged it within minutes. My bank took weeks to notice last time."**

— David K., Business Owner

**"5 hours saved is actually conservative. I probably spent 10+ hours monthly on budgeting before AI. Now I check the app for 5 minutes daily and I'm more financially aware than ever."**

— Amanda S., Marketing Manager

## How to Maximize Your Time Savings with AI Budgeting

Follow these steps to get the full benefit:

### Week 1: Setup (One-time: 30-45 minutes)

1. Choose your AI budgeting platform ([Compordo](https://www.compordo.com) recommended)

2. Connect your financial accounts (bank, credit cards, investments)

3. Review AI's initial categorization and make corrections

4. Let AI learn your patterns

### Week 2-4: Training Period (10 minutes/week)

1. Review AI-generated categories

2. Correct any errors (AI learns from corrections)

3. Accept or adjust AI-suggested budgets

4. Set up spending alerts for important categories

### Month 2+: Maintenance (15-30 minutes/month)

1. Weekly 5-minute app check-in

2. Review AI insights and alerts

3. Accept AI's next month budget or make minor adjustments

4. Act on savings recommendations

**Total time investment after setup: 15-30 minutes per month**

## The Bottom Line: Your Time and Money Back

Let's add it all up:

### Time Savings

- **Manual budgeting:** 6-8 hours/month

- **AI budgeting:** 0.5 hours/month

- **Time saved:** 5-7.5 hours/month = **60-90 hours/year**

At even a modest $25/hour opportunity cost, that's **$1,500-$2,250/year in time value**.

### Money Savings

- Eliminated subscriptions: $200-400/year

- Reduced category overspending: $200-500/year

- Avoided fees and interest: $100-300/year

- **Total: $500-1,200/year in direct savings**

### Combined Annual Value: $2,000-3,450+

And that doesn't account for:

- Reduced financial stress

- Better financial decision-making

- Faster progress toward financial goals

- Early fraud detection preventing major losses

## Getting Started with AI Budgeting Today

The best AI budgeting apps in 2025 include:

1. **Compordo** (Best overall) – Comprehensive AI budgeting + investment tracking

2. **Monarch Money** – Premium collaborative budgeting

3. **Copilot** – iOS-exclusive with beautiful design

**Our recommendation:** Start with [Compordo's free plan](https://www.compordo.com) to experience AI budgeting with zero commitment. Connect your accounts and let AI analyze your finances for a week—you'll immediately see the time savings and insights.

Upgrade to Premium ($9.99/month) when you're ready for advanced features like investment tracking and unlimited AI financial assistance.

## Conclusion: Time Is Money—Save Both

AI budgeting isn't just a "nice to have" technology—it's a practical tool that saves you real time and finds real money.

**5+ hours saved monthly** means more time for family, hobbies, side hustles, or simply relaxing instead of wrestling with spreadsheets.

**$500+ saved annually** accelerates your emergency fund, retirement savings, or debt payoff.

The question isn't whether AI budgeting is worth it—it's whether you can afford NOT to use it.

[Start Saving Time & Money with Compordo →](https://www.compordo.com)

---

*Want to share your AI budgeting time-savings story? Join our [Discord community](https://discord.gg/wxRnk2Pmrt) where users discuss real results!*