Reviews

Free AI Personal Financial Advisor: Best No-Cost Options in 2025

By Compordo Team•January 24, 2025•7 min read

# Free AI Personal Financial Advisor: Best No-Cost Options in 2025

Want an **AI personal financial advisor** but worried about the cost? Good news! There ARE quality free options available in 2025. This guide reveals the best **free AI personal financial advisor** apps, what they offer, their limitations, and how to maximize free AI financial advice.

## Can You Really Get a Free AI Personal Financial Advisor?

**Yes!** But understand what "free" means:

### Types of "Free" AI Personal Financial Advisors:

1. **Completely Free Forever**

- Example: Mint

- How they make money: Ads and affiliate recommendations

- Best for: Basic budgeting needs

2. **Freemium (Free with Paid Upgrades)**

- Example: Compordo, Personal Capital

- How they make money: Premium subscriptions

- Best for: Most people, can upgrade later

3. **Free Trial Periods**

- Example: YNAB (34 days free)

- How they make money: Paid subscriptions after trial

- Best for: Testing before committing

4. **Free for Early Adopters**

- Example: New apps offering lifetime free access

- How they make money: Later users pay

- Best for: People willing to try new apps

---

## Best Free AI Personal Financial Advisor Apps 2025

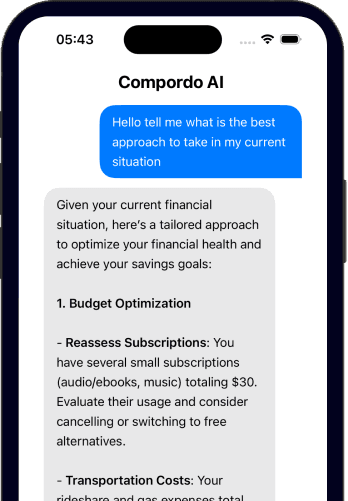

### 1. Compordo - Best Free Features

**What's Free:**

- ✅ AI-powered budget creation

- ✅ Automatic expense tracking

- ✅ Basic investment monitoring

- ✅ Financial goal setting

- ✅ Real-time insights

- ✅ Community support

**What Costs Money:**

- Advanced AI recommendations (optional)

- Premium investment analytics (optional)

- Priority support (optional)

**Best For:** People who want powerful AI without commitment

**Our Take:** Compordo offers the most generous free tier of any **AI personal financial advisor**. You get true AI capabilities, not just basic automation.

[Try Compordo Free →](https://www.compordo.com)

---

### 2. Mint - Best Completely Free Option

**What's Free:**

- ✅ Budget tracking

- ✅ Bill reminders

- ✅ Credit score monitoring

- ✅ Basic spending insights

- ✅ Account aggregation

**What Costs Money:**

- Nothing! Completely free (but...)

**The Catch:**

- ⚠️ Lots of ads

- ⚠️ Aggressive product recommendations

- ⚠️ Your data is used for marketing

- ⚠️ Limited true AI capabilities

**Best For:** People okay with ads who need basic budgeting

**Our Take:** Mint is "free" but you pay with your attention and data. The AI features are minimal compared to dedicated **AI personal financial advisors**.

---

### 3. Personal Capital - Best Free Investment Tracking

**What's Free:**

- ✅ Investment portfolio tracking

- ✅ Net worth tracking

- ✅ Retirement planning tools

- ✅ Basic budgeting

**What Costs Money:**

- Wealth management services (0.89% fee on $100k+)

**The Catch:**

- ⚠️ Frequent calls from advisors trying to sell services

- ⚠️ Better for investments than budgeting

- ⚠️ Limited AI for daily money management

**Best For:** People with $100k+ who want free portfolio tracking

**Our Take:** Great free tool for investments, but pushy sales calls can be annoying. Not a complete **AI personal financial advisor** solution.

---

### 4. Rocket Money - Free Basic Version

**What's Free:**

- ✅ Subscription tracking

- ✅ Bill negotiation (takes 30-60% of savings)

- ✅ Basic budgeting

- ✅ Spending insights

**What Costs Money:**

- Premium features: $4-12/month (choose your price)

**The Catch:**

- ⚠️ Best features are premium

- ⚠️ Limited free AI capabilities

- ⚠️ Focuses mainly on cutting subscriptions

**Best For:** People with lots of subscriptions to manage

**Our Take:** Good for subscription management, but limited as a full **AI personal financial advisor**.

---

## Free vs. Paid: What You're Actually Getting

### What Free AI Personal Financial Advisors Typically Include:

✅ **Basic Features:**

- Account linking (usually limited accounts)

- Transaction categorization

- Simple budgets

- Basic reports

- Email support

✅ **Limited AI Features:**

- Basic spending insights

- Simple recommendations

- Automated categorization

- Basic trend analysis

### What You're Missing with Free:

❌ **Advanced Features:**

- Predictive analytics

- Complex financial planning

- Advanced investment insights

- Multiple financial scenarios

- Custom categories and rules

❌ **Better AI:**

- Personalized learning

- Sophisticated recommendations

- Proactive alerts

- Deep pattern recognition

- Natural language Q&A

❌ **Support & Service:**

- Priority customer support

- Phone support

- Personal onboarding

- Advanced training

---

## How to Maximize Free AI Personal Financial Advisor Apps

### Strategy 1: Stack Multiple Free Apps

Use different free apps for different purposes:

- **Compordo** → Daily budgeting and AI insights

- **Personal Capital** → Investment tracking

- **Credit Karma** → Credit monitoring

**Pros:** Get best-of-breed features free

**Cons:** Managing multiple apps takes more time

### Strategy 2: Use Freemium Strategically

Start free, upgrade for 1-2 months during tax season or major financial planning, then downgrade:

- **January-February:** Upgrade for tax planning

- **March-December:** Use free tier

- Save money while getting premium when needed

### Strategy 3: Take Advantage of Trials

Rotate through trial periods to access premium features:

- **Month 1:** Trial App A

- **Month 2:** Trial App B

- **Month 3:** Trial App C

- **Month 4:** Back to App A (often can get another trial with new email)

**Ethical Note:** Only do this if genuinely evaluating. Don't abuse trial systems.

### Strategy 4: Use Community & Free Resources

Combine free **AI personal financial advisor** with:

- Free Discord/Reddit communities

- Free financial literacy content

- Free educational resources

- Free calculators and tools

---

## Warning Signs: When "Free" Isn't Worth It

### Red Flag #1: Too Many Ads

If ads make the app unusable, your time is worth more than $5/month.

### Red Flag #2: Aggressive Upselling

Constant popups pushing premium? They're making the free version bad on purpose.

### Red Flag #3: Data Selling

Read privacy policy. If they sell your financial data, the "free" cost is your privacy.

### Red Flag #4: Outdated Technology

Some free apps haven't been updated in years. Old AI = bad recommendations.

### Red Flag #5: Hidden Limitations

"Free for 2 accounts" but you have 5? You'll hit limits fast.

---

## Should You Pay for an AI Personal Financial Advisor?

Consider paying if:

### You Should Pay When:

- ✅ You manage $50k+ in assets

- ✅ Time saved is worth $10-15/month

- ✅ You need advanced AI features

- ✅ You value privacy (no ads/data selling)

- ✅ You want priority support

### Stay Free When:

- ✅ Just starting financial journey

- ✅ Simple financial situation

- ✅ Comfortable with ads

- ✅ Okay with limited features

- ✅ Don't mind data being used

---

## Value Calculation: Is Free Really Saving You Money?

Let's do the math:

### Scenario: Using Free App with Ads

- **Time spent on ads:** 2 min/day = 60 min/month

- **Your hourly value:** $20/hour (minimum wage)

- **Cost in time:** 60 min = $20/month

- **Missed savings from weaker AI:** $50/month

- **Total hidden cost:** $70/month

### Scenario: Paying $10/month for Premium

- **Time spent on ads:** 0

- **Better AI saves:** $100/month (conservative estimate)

- **Total value:** $90/month benefit

**Reality:** Sometimes "free" costs more than paid!

---

## Best "Free" Option: Early Adopter Programs

The smartest way to get a premium **AI personal financial advisor** free:

### Look for:

1. **New apps offering lifetime free for early users**

2. **Beta programs with permanent free access**

3. **Referral programs with free upgrades**

4. **Student/educator free accounts**

**Example:** Compordo often offers special programs for early adopters and active community members.

---

## How to Choose Your Free AI Personal Financial Advisor

### Step 1: List Your Must-Have Features

- Need investment tracking? → Personal Capital free tier

- Need budgeting focus? → Compordo or Mint

- Need subscription management? → Rocket Money

### Step 2: Check Privacy Policies

- **Good:** "We never sell your data"

- **Bad:** "We share data with partners"

### Step 3: Test User Experience

- Download 2-3 free options

- Use each for 1 week

- Pick the one you'll actually use

### Step 4: Read Recent Reviews

- Check App Store/Google Play

- Look at reviews from last 30 days

- See if free tier is still good

### Step 5: Evaluate Upgrade Path

- Can you upgrade later if needed?

- Is the paid tier worth it?

- Are you locked in or can you downgrade?

---

## Free AI Personal Financial Advisor FAQs

### Q: "Is a free AI personal financial advisor as good as paid?"

**A:** For basic budgeting, yes! For advanced features like sophisticated AI recommendations, investment optimization, and predictive analytics, paid versions are significantly better.

### Q: "How do free AI advisors make money?"

**A:** Three ways:

1. Ads (like Mint)

2. Freemium upsells (like Compordo)

3. Affiliate commissions (recommending financial products)

### Q: "What's the catch with free?"

**A:** Usually limited features, ads, or your data being used for marketing. Read the fine print!

### Q: "Can I switch from free to paid later?"

**A:** Yes! Most apps let you upgrade anytime and keep all your data.

### Q: "Are free options secure?"

**A:** Reputable free **AI personal financial advisors** use the same bank-level security as paid apps. Security shouldn't differ.

---

## Conclusion: The Best Free Strategy

**Our Recommendation:**

1. **Start with Compordo's free tier**

- Best free AI features

- No ads

- Full budgeting capabilities

- Can upgrade later if needed

2. **Add Personal Capital for investments** (if you have $10k+)

- Free portfolio tracking

- Ignore sales calls

- Just use the free tools

3. **Evaluate after 3 months**

- Still working well? Stay free!

- Hitting limitations? Consider upgrading

- Not using it? Try different app

**Bottom Line:** You CAN get excellent AI financial advice for free in 2025, but be realistic about limitations. Start free, upgrade when it makes financial sense.

The best **free AI personal financial advisor** is one you'll actually use consistently—even if that means paying a small amount for a better experience.

[Start Free with Compordo →](https://www.compordo.com)

---

*Want to chat with others using free AI personal financial advisors? Join our [Discord community](https://discord.gg/wxRnk2Pmrt) where we share tips, tricks, and deals!*