Financial Planning

AI Retirement Planning: Complete Guide to Automated Retirement Strategy 2025

By Compordo Team•January 21, 2025•13 min read

# AI Retirement Planning: Complete Guide to Automated Retirement Strategy 2025

Planning for retirement is one of the most important financial decisions you'll ever make—and in 2025, AI retirement planning tools are revolutionizing how people prepare for their golden years. From predictive analytics to automated contribution optimization, AI makes retirement planning more accurate, accessible, and actionable than ever before.

This comprehensive guide explores how AI retirement planning works, the best tools available, and how you can leverage artificial intelligence to build a secure financial future.

## What is AI Retirement Planning?

AI retirement planning uses artificial intelligence, machine learning, and predictive analytics to create personalized retirement strategies. Unlike traditional retirement calculators that rely on static assumptions, AI retirement planning tools continuously analyze your financial situation, market conditions, and spending patterns to provide dynamic, data-driven recommendations.

### Key Features of AI Retirement Planning Tools:

- **Predictive Retirement Modeling:** AI forecasts your retirement needs based on current spending, inflation, and life expectancy

- **Automated Contribution Optimization:** Calculates optimal retirement savings rates to meet your goals

- **Dynamic Portfolio Rebalancing:** Adjusts asset allocation automatically as you approach retirement

- **Tax-Efficient Withdrawals:** AI determines the most tax-efficient way to draw down retirement accounts

- **Social Security Optimization:** Analyzes the best time to claim Social Security benefits

- **Real-Time Tracking:** Monitors your progress toward retirement goals 24/7

## Why Traditional Retirement Planning Falls Short

Traditional retirement planning has significant limitations:

### 1. **Static Assumptions**

Traditional calculators use fixed assumptions (3% inflation, 7% returns) that don't reflect real-world volatility. AI retirement planning adapts to actual market conditions and your changing financial situation.

### 2. **One-Size-Fits-All Advice**

Generic rules like "save 15% of income" or "retire with 80% of final salary" don't account for your unique circumstances. AI personalizes every recommendation based on YOUR data.

### 3. **Infrequent Updates**

Most people review retirement plans annually (or less). AI retirement planning provides continuous monitoring and alerts you to important changes instantly.

### 4. **Difficulty Factoring in Complex Variables**

Life changes—career transitions, inheritances, health issues, family obligations—complicate retirement planning. AI handles these variables dynamically rather than requiring manual recalculation.

### 5. **Limited Scenario Planning**

Traditional methods make it hard to simulate "what if" scenarios. AI retirement planning lets you instantly model different retirement ages, spending levels, and market conditions.

## How AI Retirement Planning Works: The Technology

AI retirement planning combines several advanced technologies:

### 1. Machine Learning for Spending Pattern Analysis

AI analyzes years of spending data to predict your realistic retirement expenses. Research shows AI-powered forecasting delivers **50% better accuracy** than manual estimation.

**Example:** If you spend $4,500/month now, traditional methods assume you'll need 80% ($3,600) in retirement. AI might discover that after mortgage payoff and commute elimination, you'll realistically need $3,200—significantly impacting required savings.

### 2. Monte Carlo Simulations

AI runs thousands of market scenarios to calculate your probability of retirement success under different conditions. Instead of "you need $1.5 million," AI tells you "you have an 87% chance of success with current savings rate."

### 3. Predictive Analytics for Life Events

AI factors in statistically likely life events (healthcare costs, family support needs, longevity) based on demographic data and your personal circumstances.

### 4. Tax Optimization Algorithms

AI calculates optimal withdrawal strategies across taxable accounts, 401(k)s, Roth IRAs, and other vehicles to minimize lifetime tax burden. By 2025, **30% of investments are managed by AI-driven robo-advisors**, many with sophisticated tax optimization.

### 5. Dynamic Asset Allocation

Traditional advice uses age-based rules ("100 minus your age = % in stocks"). AI adjusts allocation based on actual risk tolerance, time horizon, and market valuations, improving returns while managing risk.

## The Benefits of AI Retirement Planning

### 1. **Personalized Retirement Roadmap**

AI creates a specific plan tailored to YOUR situation:

- Current age, income, and savings

- Desired retirement age and lifestyle

- Risk tolerance and investment preferences

- Other financial goals (home purchase, education, travel)

- Health considerations and life expectancy

### 2. **Continuous Optimization**

AI retirement planning doesn't set it and forget it:

- Monitors portfolio performance daily

- Adjusts contribution recommendations as income changes

- Rebalances automatically to maintain target allocation

- Updates projections as you age and approach retirement

### 3. **Early Warning System**

AI alerts you immediately when you're off track:

- "At current savings rate, you'll fall $200,000 short of retirement goal"

- "Market downturn has reduced retirement success probability to 72%—consider increasing contributions"

- "You're on track to retire 2 years early based on recent performance"

### 4. **Scenario Planning Made Easy**

Instantly model different possibilities:

- What if I retire at 62 vs. 67?

- How does buying a vacation home affect retirement?

- What if I take a lower-paying job I love more?

- How would a market crash next year impact my plans?

### 5. **Time Savings**

AI handles complex calculations that would take hours manually. Users save **5+ hours per month** on financial management with AI tools.

### 6. **Cost-Effective**

AI retirement planning costs $0-$20/month vs. 1-2% annual fees ($1,000-$2,000+ annually on a $100,000 portfolio) charged by human financial advisors.

## Best AI Retirement Planning Tools 2025

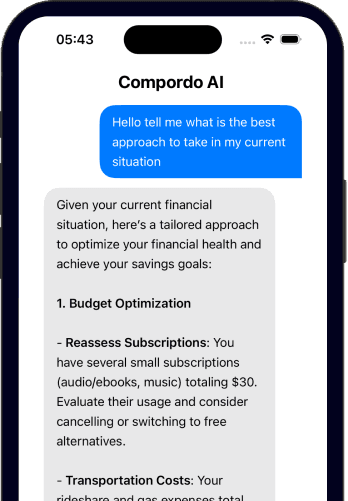

### 1. Compordo – Best Comprehensive AI Retirement & Financial Planning

[Compordo](https://www.compordo.com) offers integrated AI retirement planning alongside budgeting and investment tracking, making it ideal for holistic financial management.

**Retirement Features:**

- AI-powered retirement projections based on actual spending patterns

- Automated retirement savings tracking across all accounts

- Goal-based planning with real-time progress monitoring

- Investment performance analytics

- Personalized recommendations to reach retirement goals faster

**Pricing:** Free plan available; Premium $9.99/month

**Best For:** People who want retirement planning integrated with daily budgeting and investment tracking

### 2. Wealthfront – Best AI Robo-Advisor for Retirement Investing

Wealthfront's **Path** tool combines AI retirement planning with automated investment management.

**Retirement Features:**

- Path retirement planning tool with Monte Carlo simulations

- Automated retirement account management

- Tax-loss harvesting to boost after-tax returns

- 529 college savings integration

- Home planning and advice

**Pricing:** 0.25% annual advisory fee

**Best For:** Hands-off investors who want AI to manage retirement investments

### 3. Betterment – Best for Beginner AI Retirement Planning

Betterment makes AI retirement planning accessible for beginners with guided setup and educational resources.

**Retirement Features:**

- RetireGuide tool with personalized projections

- Goal-based retirement accounts

- Social Security optimization calculator

- Tax-coordinated portfolio management

- Optional human advisor access (Premium plan)

**Pricing:** 0.25% annual fee (Digital); 0.65% (Premium with human advisors)

**Best For:** Retirement planning beginners who want simple AI guidance plus optional human support

### 4. Personal Capital – Best Free AI Retirement Planner

Personal Capital offers sophisticated free AI retirement planning tools (though they upsell wealth management services).

**Retirement Features:**

- Retirement Planner with Monte Carlo analysis

- Fee Analyzer to identify expensive funds

- Investment Checkup tool

- Net worth tracking

- Free retirement projections

**Pricing:** Free tools; optional wealth management 0.49-0.89% fee

**Best For:** DIY investors who want free advanced AI retirement planning

### 5. Empower (formerly Personal Capital) – Best for High-Net-Worth AI Planning

Empower targets high-net-worth individuals with sophisticated AI retirement planning.

**Retirement Features:**

- Advanced retirement projections

- Multi-account portfolio management

- Tax optimization strategies

- Estate planning integration

- Dedicated advisor team

**Pricing:** 0.49-0.89% based on assets

**Best For:** High-net-worth individuals ($100,000+ investable assets) seeking premium AI + human hybrid service

## Step-by-Step: Using AI to Plan Your Retirement

### Step 1: Assess Your Current Financial Situation (Week 1)

**Gather your data:**

- Current age and desired retirement age

- All retirement account balances (401k, IRA, Roth IRA, etc.)

- Current annual income and expenses

- Expected Social Security benefits

- Other assets (home equity, taxable investments, pensions)

- Debts and obligations

**Action:** Connect accounts to your chosen AI retirement planning tool (Compordo recommended for comprehensive approach)

### Step 2: Define Your Retirement Goals (Week 1)

**Answer key questions:**

- What age do you want to retire?

- What lifestyle do you envision? (travel, hobbies, housing)

- Where will you live? (current home, downsize, relocate)

- What's your realistic monthly spending in retirement?

- What legacy do you want to leave?

**Action:** Input your goals into the AI tool. Be honest and specific—AI works best with accurate data.

### Step 3: Review AI's Retirement Projections (Week 2)

AI will calculate:

- **Target retirement savings number** based on your goals and life expectancy

- **Current trajectory** showing if you're on track

- **Probability of success** (typically 70-90% is considered good)

- **Recommended monthly savings** to meet your goals

- **Optimal investment allocation** for your time horizon

**Example AI Output:**

- "To retire at 65 with $75,000/year income, you need $1.8 million"

- "Currently on track to accumulate $1.4 million"

- "$400,000 shortfall (76% success rate)"

- "Increase monthly contributions by $350 to reach 85% success rate"

### Step 4: Implement AI Recommendations (Week 2-3)

**Typical AI recommendations:**

- Increase 401(k) contributions to capture full employer match

- Open and fund a Roth IRA ($7,000/year for those under 50)

- Adjust investment allocation based on risk tolerance and timeline

- Consider Health Savings Account (HSA) for tax-advantaged retirement healthcare savings

- Optimize debt payoff strategy to free up retirement contributions

**Action:** Set up automatic contributions and portfolio allocations recommended by AI

### Step 5: Run "What If" Scenarios (Week 3)

Test different possibilities:

- **Early retirement:** "What if I retire at 60 instead of 65?"

- **Part-time work:** "What if I work part-time for 5 years after 65?"

- **Market crash:** "How would a 30% market drop next year affect my plans?"

- **Lifestyle changes:** "What if I spend $5,000/month instead of $6,000?"

- **Inheritance:** "How does a potential $200,000 inheritance change things?"

AI instantly recalculates probability of success for each scenario.

### Step 6: Monitor and Adjust Quarterly (Ongoing)

AI provides continuous monitoring, but schedule quarterly reviews:

- Check retirement success probability

- Adjust for income changes (raises, bonuses, job changes)

- Update spending patterns

- Rebalance if needed (often automatic)

- Celebrate milestones

**Pro Tip:** Set up alerts for important thresholds. AI can notify you when:

- Success probability drops below 80%

- You're on track to retire early

- Major market movements affect your plan

- Contribution adjustments are recommended

## Common AI Retirement Planning Questions

### How much do I need to retire?

AI calculates your specific number based on:

- Desired retirement lifestyle and spending

- Retirement age and life expectancy

- Social Security and other income sources

- Healthcare costs and inflation

**Traditional rule of thumb:** 25x annual expenses (so $1.5 million for $60k/year)

**AI advantage:** Personalized calculation might show you need $1.2 million or $1.8 million based on YOUR situation

### What if I'm behind on retirement savings?

AI provides specific catch-up strategies:

- Max out catch-up contributions if age 50+ (extra $7,500 to 401k, $1,000 to IRA in 2025)

- Adjust retirement age (working 2 more years dramatically improves outlook)

- Optimize Social Security claiming (delaying from 62 to 70 increases benefits ~77%)

- Reduce planned retirement spending

- Generate additional income (side hustle, rental income)

**Example:** AI might show that working until 67 instead of 65 AND increasing contributions by $200/month takes you from 68% to 88% success probability.

### How does AI handle market volatility?

AI uses Monte Carlo simulations running 10,000+ market scenarios (bull markets, bear markets, crashes, everything in between) to calculate your success probability across all outcomes.

**Key insight:** AI shows you're not planning for average returns—you're planning to succeed even in bad scenarios.

### Can I trust AI retirement projections?

AI projections are more reliable than manual estimates because:

- Based on your ACTUAL spending, not generic assumptions

- Continuously updated with real data

- Account for hundreds of variables simultaneously

- **50% more accurate** than traditional forecasting methods

However, remember:

- Projections are probabilistic, not guaranteed

- Garbage in = garbage out (provide accurate information)

- AI should complement, not replace, human judgment for complex situations

### Should I still see a human financial advisor?

For most people, AI retirement planning is sufficient for ages 20-55 with straightforward situations.

**Consider adding human advisor if:**

- You have $500,000+ in assets

- You own a business requiring succession planning

- You need complex estate planning (trusts, multi-generational wealth transfer)

- You have unique circumstances (special needs dependents, complex divorce, inheritance issues)

- You need emotional accountability and motivation

**Hybrid approach:** Use AI for daily retirement tracking and optimization, consult fee-only CFP every 2-3 years for major life events and complex planning.

## Advanced AI Retirement Planning Strategies

### 1. Tax-Efficient Withdrawal Strategies

AI calculates optimal withdrawal order from different account types:

**Typical AI recommendation (ages 65-72):**

- Withdraw from taxable accounts first (qualified dividends, long-term capital gains taxed favorably)

- Delay Social Security to age 70 (increases benefits 8%/year)

- Convert traditional IRA to Roth IRA in low-income years (pay taxes now in lower bracket)

- Begin Required Minimum Distributions (RMDs) at 73

**After age 72:**

- Take RMDs from traditional retirement accounts (required by law)

- Supplement with Roth IRA withdrawals (tax-free)

- Use taxable account for large expenses

**Tax savings:** AI tax optimization can save $50,000-$200,000+ over retirement

### 2. Geographic Arbitrage

AI factors cost-of-living differences into retirement planning:

**Example:** Retiring in Austin, TX vs. San Francisco, CA

- Same lifestyle costs $45,000/year in Austin vs. $70,000/year in SF

- Retirement savings needed: $1.125 million vs. $1.75 million

- **$625,000 difference** or ability to retire 8+ years earlier

AI helps model geographic moves and their retirement impact.

### 3. Phased Retirement

Instead of binary work/retire, AI models gradual transitions:

- Ages 60-65: Reduce to 30 hours/week, supplement income with savings

- Ages 65-70: Consulting/part-time work (20 hours/week), delay Social Security

- Age 70+: Full retirement with maximized Social Security

**Benefits:** Less retirement savings needed, continued engagement, health insurance through employer

### 4. Healthcare Cost Planning

Healthcare is often retirement's biggest wildcard. AI factors in:

- Medicare premiums (Parts A, B, D, supplemental)

- Out-of-pocket maximums

- Long-term care possibilities

- Health Savings Account (HSA) as "stealth IRA"

**Estimated lifetime healthcare costs:** $300,000-$600,000 per couple in retirement

**AI advantage:** Personalized estimate based on your health history and family longevity

## Common AI Retirement Planning Mistakes to Avoid

### 1. Underestimating Retirement Expenses

Many people assume they'll spend 30-40% less in retirement, but research shows retirees often spend MORE in early retirement years (travel, hobbies, home improvements).

**Solution:** Let AI analyze your ACTUAL spending patterns rather than guessing

### 2. Forgetting Healthcare Costs

Medicare doesn't cover everything—premiums, deductibles, and long-term care add up.

**Solution:** Use AI tools that specifically factor in healthcare inflation (typically 5-7% vs. 2-3% general inflation)

### 3. Ignoring Longevity Risk

Planning to age 85 when you might live to 95 creates 10 years of financial insecurity.

**Solution:** AI uses actuarial tables and your health data to plan for appropriate life expectancy (often age 90-95)

### 4. Overlooking Tax Implications

All retirement savings are not equal—$100,000 in traditional 401(k) vs. Roth IRA have very different after-tax values.

**Solution:** AI calculates tax-adjusted retirement projections showing after-tax spending power

### 5. Setting It and Forgetting It

Retirement plans need adjustments as life changes.

**Solution:** AI provides continuous monitoring and alerts—check quarterly but trust AI to flag important changes

## The Future of AI Retirement Planning

By 2025 and beyond, expect even more sophisticated AI retirement planning:

### Emerging Capabilities:

- **AI-powered longevity predictions** using genetic data and health metrics

- **Real-time economic modeling** adjusting for inflation, interest rates, market valuations

- **Integrated long-term care planning** with insurance recommendations

- **Voice-activated retirement assistants** (Alexa/Google-style interfaces for retirement questions)

- **Behavioral nudges** using AI to improve retirement saving habits

- **Cryptocurrency retirement integration** for alternative asset allocation

### The AI + Human Hybrid Model:

The future isn't AI vs. human advisors—it's AI handling data analysis and optimization while humans provide wisdom, accountability, and emotional support for complex decisions.

## Getting Started with AI Retirement Planning Today

### Recommended Approach:

**For Comprehensive Financial Management:**

1. Start with [Compordo's free plan](https://www.compordo.com)

2. Connect all financial accounts

3. Set retirement goals in the app

4. Review AI's retirement projections

5. Implement recommended contribution and allocation changes

6. Monitor quarterly

**For Investment-Focused Retirement:**

1. Open Wealthfront or Betterment account

2. Complete retirement questionnaire

3. Fund retirement accounts

4. Let AI manage investments automatically

5. Use Path/RetireGuide tools for projections

### Quick Wins (Do These First):

✅ Increase 401(k) to capture full employer match (free money!)

✅ Open Roth IRA if eligible ($7,000/year for under-50)

✅ Automate retirement contributions (set it and forget it)

✅ Check investment fees (move expensive funds to index funds)

✅ Estimate Social Security benefits at SSA.gov

## Conclusion: Your AI-Powered Path to Retirement Security

AI retirement planning democratizes access to sophisticated financial strategies once available only to the wealthy. Whether you're 25 and just starting or 55 playing catch-up, AI provides personalized, data-driven guidance to help you retire with confidence.

The combination of **50% better forecasting accuracy**, **5+ hours monthly time savings**, and **continuous optimization** makes AI retirement planning tools essential for anyone serious about financial freedom.

**Key Takeaways:**

- AI personalizes retirement planning based on YOUR actual data, not generic rules

- Continuous monitoring catches problems early when they're easier to fix

- Scenario planning helps you make informed decisions about retirement tradeoffs

- AI tools cost a fraction of traditional advisor fees

- Start today—the earlier you plan, the easier retirement becomes

**Ready to take control of your retirement future?**

[Start AI-Powered Retirement Planning with Compordo →](https://www.compordo.com)

---

*Want to discuss AI retirement planning strategies? Join our [Discord community](https://discord.gg/wxRnk2Pmrt) where thousands of users share retirement insights and experiences!*