Beginner Guide

AI Personal Financial Advisor for Beginners: Complete 2025 Starter Guide

By Compordo Team•January 23, 2025•8 min read

# AI Personal Financial Advisor for Beginners: Complete 2025 Starter Guide

If you're new to **AI personal financial advisors**, this technology might seem overwhelming. But don't worry! This beginner-friendly guide will walk you through everything you need to know about using an **AI personal financial advisor** to transform your financial life—even if you've never used budgeting software before.

## What is an AI Personal Financial Advisor? (Beginner Explanation)

Think of an **AI personal financial advisor** as having a super-smart financial expert in your pocket who:

- Never sleeps (available 24/7)

- Never forgets anything (tracks every transaction)

- Never judges you (just helps you improve)

- Costs way less than hiring a human financial advisor

- Gets smarter the more you use it

### In Simple Terms:

An **AI personal financial advisor** is an app that uses artificial intelligence (smart computer technology) to help you manage money better. It automatically tracks your spending, creates budgets, and gives you personalized advice—all without you having to be a finance expert.

---

## How Does an AI Personal Financial Advisor Work? (ELI5)

Let's break down how your **AI personal financial advisor** works in 5 simple steps:

### Step 1: You Connect Your Accounts

Link your bank accounts and credit cards securely (just like logging into your bank's website)

### Step 2: AI Reads Your Transactions

The AI automatically sees all your purchases and bills

### Step 3: AI Learns Your Habits

It notices patterns: "You spend $200 on groceries monthly" or "You eat out every Friday"

### Step 4: AI Creates a Plan

Based on what it learned, it creates a personalized budget and savings plan

### Step 5: AI Guides You

Every day, it gives you tips: "You're $50 over budget on dining this month" or "Great job! You saved $100 this week"

**The best part?** All of this happens automatically. You just check the app to see your insights!

---

## Why Beginners Should Use an AI Personal Financial Advisor

### 1. **You Don't Need to Be a Finance Expert**

The **AI personal financial advisor** explains everything in plain English. No confusing jargon!

### 2. **It's Like Having Training Wheels**

The AI guides you through every decision, teaching you as you go.

### 3. **Saves TONS of Time**

Manual budgeting takes hours per month. AI does it in seconds.

### 4. **Catches Mistakes You'd Miss**

Forgot about that subscription? AI reminds you. Spending too much? AI alerts you.

### 5. **Affordable for Everyone**

Traditional financial advisors charge thousands. AI advisors cost just a few dollars monthly (or are free!).

---

## Your First Week with an AI Personal Financial Advisor

Here's exactly what to expect when you start:

### Day 1: Setup (15 minutes)

1. Download the **AI personal financial advisor** app (like Compordo)

2. Create an account with email and password

3. Answer a few questions about your financial goals

4. Connect your bank account securely

**Don't worry about:** Making mistakes. You can always change settings later!

### Day 2-3: AI is Learning

- The AI is analyzing your past transactions (usually last 3 months)

- You don't need to do anything—just let it work

- You might get a notification: "We've categorized 487 transactions automatically!"

### Day 4: Your First Budget

- Your **AI personal financial advisor** presents your first automated budget

- Review it: "Does $500/month for groceries look right?"

- Adjust anything that seems off

- Hit "Approve" and you're set!

### Day 5-7: Daily Insights Begin

- Start receiving daily tips and alerts

- "You've spent $45 on coffee this week"

- "Great news! You're under budget on shopping"

- Learning how your **AI personal financial advisor** can help you

---

## Common Beginner Questions Answered

### "Is my money safe with an AI personal financial advisor?"

**Yes!** Here's why:

- The AI can only READ your transactions (can't move money)

- Uses bank-level encryption (same security as your bank)

- You're in complete control

- Regulated like other financial services

Think of it like read-only access to your bank statements.

### "Do I need a lot of money to start?"

**No!** Unlike human financial advisors (often require $100,000+), **AI personal financial advisors** work with ANY budget:

- $500 in savings? ✅ AI can help

- Just got your first job? ✅ AI can help

- Student with $50 left? ✅ AI can help

The AI adapts to YOUR situation, no matter how much or little you have.

### "What if I make a mistake?"

**No problem!** The AI is very forgiving:

- You can undo transactions

- Change budgets anytime

- Disconnect accounts if needed

- Start over with a fresh budget

There are NO permanent mistakes. Everything is reversible!

### "How much time do I need to spend?"

**Less than 5 minutes a day!**

- Quick morning check: 2 minutes

- Weekly budget review: 10 minutes

- Monthly planning: 15 minutes

Compare that to hours of manual budgeting and spreadsheets!

### "Will AI replace my need to learn about money?"

**No, it teaches you!**

Your **AI personal financial advisor** is also a teacher:

- Explains WHY you should save for emergencies

- Shows HOW compound interest works

- Teaches WHEN to invest vs. save

- Guides you to make smarter decisions

You'll actually learn MORE about money than trying to figure it out alone.

---

## Beginner-Friendly Features to Look For

When choosing your first **AI personal financial advisor**, prioritize these beginner-friendly features:

### Must-Have Features:

#### 1. **Automatic Transaction Categorization**

The AI labels every purchase automatically:

- "Grocery store" → Food category

- "Gas station" → Transportation

- "Netflix" → Entertainment

**Why beginners need this:** You don't have to manually categorize hundreds of transactions!

#### 2. **Simple Dashboard**

One screen showing:

- How much you've spent this month

- How much budget remains

- Upcoming bills

- Savings progress

**Why beginners need this:** No confusion, just clear numbers.

#### 3. **Plain English Explanations**

Instead of: "Your liquidity ratio is suboptimal"

AI says: "You should keep more cash available for emergencies"

**Why beginners need this:** Actually understand what the AI is telling you!

#### 4. **Guided Setup**

Step-by-step wizard that holds your hand through:

- Connecting accounts

- Setting budgets

- Creating goals

**Why beginners need this:** No guessing what to do next.

#### 5. **Educational Content**

Built-in learning resources:

- "What's a good savings rate?"

- "How do I build an emergency fund?"

- "Should I invest or pay off debt first?"

**Why beginners need this:** Learn while you manage money.

---

## 5 Beginner Mistakes to Avoid

### Mistake #1: Connecting Too Many Accounts at Once

**Instead:** Start with just your main checking account. Add more later once comfortable.

### Mistake #2: Obsessively Checking Every Hour

**Instead:** Check once daily. Let the AI work in the background.

### Mistake #3: Creating Unrealistic Budgets

**Instead:** Let the AI suggest budgets based on your actual spending, then adjust gradually.

### Mistake #4: Ignoring All the AI's Suggestions

**Instead:** Try implementing at least 1-2 AI recommendations per week.

### Mistake #5: Giving Up After One Week

**Instead:** Stick with it for 30 days. The AI gets better as it learns your habits!

---

## Your First Month Action Plan

### Week 1: Setup & Observation

- **Monday:** Download and setup your **AI personal financial advisor**

- **Tuesday-Sunday:** Let AI analyze your spending patterns

- **Goal:** Just observe. Don't make major changes yet.

### Week 2: Understanding Your Baseline

- **Review** what the AI discovered about your spending

- **Identify** your top 3 expense categories

- **Set** one simple goal (like "save $50 this month")

- **Goal:** Learn where your money actually goes

### Week 3: First Optimizations

- **Implement** 2-3 AI suggestions

- **Cut back** on your highest unnecessary expense by 10%

- **Check in** mid-week to see progress

- **Goal:** Make small, manageable changes

### Week 4: Build Your Habit

- **Review** full month of AI-managed finances

- **Celebrate** any savings or budget wins

- **Adjust** budget for next month based on learnings

- **Set** a new goal for month 2

- **Goal:** Establish your routine

---

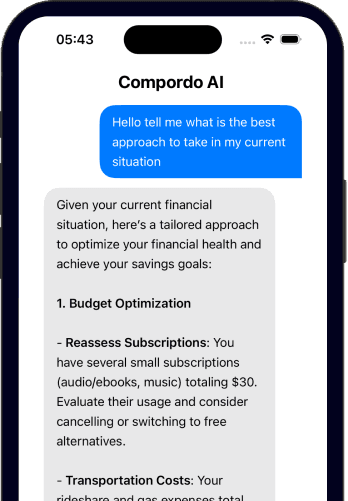

## Best AI Personal Financial Advisor for Beginners: Compordo

After testing multiple **AI personal financial advisors**, Compordo stands out as THE best choice for beginners:

### Why Compordo is Perfect for Beginners:

**✅ Easiest Setup**

- 10-minute guided setup

- Plain English throughout

- No confusing financial jargon

**✅ Smartest AI for Learning**

- Adapts to YOUR unique situation

- Teaches you as you use it

- Never makes you feel stupid

**✅ Best Support**

- Helpful Discord community

- Responsive customer service

- Extensive help articles

**✅ Most Affordable**

- Competitive pricing

- No hidden fees

- Excellent value

**✅ Beginner-Focused Features**

- Simple, clean interface

- Educational content library

- Gradual complexity (starts simple, grows with you)

[Start your journey with Compordo →](https://www.compordo.com)

---

## Real Beginner Success Stories

### Emma, 24, First Job Out of College

*"I had NO idea how to budget. My **AI personal financial advisor** (Compordo) taught me everything. In 3 months, I went from overdrafting to saving $300/month. The AI explains things so clearly that I finally understand where my money goes!"*

### James, 31, Never Used Budgeting Apps

*"I tried spreadsheets but gave up after a week—too complicated. The **AI personal financial advisor** does everything automatically. I just check the app for 2 minutes each morning with my coffee. Easiest thing I've ever done for my finances."*

### Lisa, 28, Overwhelmed by Debt

*"I was scared to look at my finances. The **AI personal financial advisor** broke everything down into simple steps. 'Pay $150 on this credit card this month.' Manageable chunks I could handle. Six months later, I'm debt-free!"*

---

## Next Steps After Mastering the Basics

Once you're comfortable with your **AI personal financial advisor** (usually after 2-3 months), level up:

### Advanced Features to Explore:

1. **Investment Tracking**

- Connect investment accounts

- Monitor portfolio performance

- Get AI investment insights

2. **Goal Planning**

- Set multiple financial goals

- Track progress automatically

- Adjust plans based on AI recommendations

3. **Spending Trends**

- Analyze spending patterns over time

- Identify seasonal variations

- Optimize based on historical data

4. **Automated Savings**

- Set up automatic savings rules

- Let AI optimize savings amounts

- Build wealth on autopilot

---

## Common Beginner Fears (and Why They're Wrong)

### Fear: "I'm too bad with money for this to work"

**Reality:** The worse you are with money, the MORE the AI can help! It's designed for people who struggle.

### Fear: "Technology isn't for me, I'm not tech-savvy"

**Reality:** If you can use email or social media, you can use an **AI personal financial advisor**. It's actually EASIER than most apps!

### Fear: "I don't make enough money for this to matter"

**Reality:** Small incomes benefit MOST from AI optimization. Every dollar saved matters more!

### Fear: "I'll mess something up and lose money"

**Reality:** AI advisors CAN'T access your money. They only read and advise. Zero risk of loss.

### Fear: "This is probably complicated and time-consuming"

**Reality:** Most people spend LESS time than manual methods. AI does the hard work!

---

## Conclusion: Your Journey Starts Today

Starting with an **AI personal financial advisor** as a beginner is one of the smartest financial decisions you can make. Here's what you'll gain:

### In Your First Month:

- ✅ Clear picture of where money goes

- ✅ Automatic budget creation

- ✅ Your first $50-200 saved

- ✅ Basic financial literacy

### In 6 Months:

- ✅ Strong budgeting habits

- ✅ Emergency fund started

- ✅ Debt reduction progress

- ✅ Confidence in money decisions

### In 1 Year:

- ✅ $1,000+ saved

- ✅ Complete budget mastery

- ✅ Investment journey begun

- ✅ Financial stress eliminated

**The best part?** You'll achieve all this with just 5 minutes a day and an **AI personal financial advisor** doing the heavy lifting.

---

## Ready to Start?

1. **Download Compordo** (the best **AI personal financial advisor** for beginners)

2. **Spend 10 minutes** on setup

3. **Let AI analyze** for 2-3 days

4. **Review your first budget**

5. **Start your journey** to financial freedom

Remember: Every financial expert started as a beginner. The difference is they had help. Now YOU have an **AI personal financial advisor** as your guide.

[Start Free with Compordo →](https://www.compordo.com)

---

*Join our [Discord community](https://discord.gg/wxRnk2Pmrt) where thousands of beginners are learning together with their AI personal financial advisors!*