Student Finance

AI Budgeting for Students: Save Money & Build Wealth in College 2025

By Compordo Team•January 21, 2025•9 min read

# AI Budgeting for Students: Save Money & Build Wealth in College 2025

Being a student means juggling classes, social life, maybe a part-time job—and somehow making your limited money stretch until next semester. Traditional budgeting advice doesn't work for student life's unpredictable expenses and irregular income. That's where AI budgeting for students changes everything.

AI-powered budgeting apps help students automatically track spending, identify savings opportunities, and build healthy financial habits—without the spreadsheet headaches. This guide shows you exactly how to use AI budgeting tools to take control of your student finances in 2025.

## Why Students Need AI Budgeting Tools

Student financial life is uniquely challenging:

### The Student Budget Reality:

❌ **Irregular income** (part-time work, gig economy, parental support)

❌ **Unpredictable expenses** (textbooks, late-night study snacks, emergency Uber home)

❌ **Semester-based cycles** (tuition due dates, housing deposits, summer income gaps)

❌ **Zero financial cushion** (no emergency fund if you overspend)

❌ **No time for complex budgeting** (spreadsheets? When you have 3 exams this week?)

❌ **First time managing money** (no prior budgeting experience)

### How AI Solves Student Budget Problems:

✅ **Automatic expense tracking** - No manual entry, see where every dollar goes

✅ **Instant spending insights** - "You spent $180 on coffee this month"

✅ **Smart budget suggestions** - AI learns YOUR spending patterns

✅ **Subscription alerts** - Catch that forgotten Spotify or gym membership

✅ **5 minutes monthly** vs. hours with spreadsheets

✅ **Free or ultra-affordable** - Many excellent options under $10/month

## Best Free AI Budgeting Apps for Students

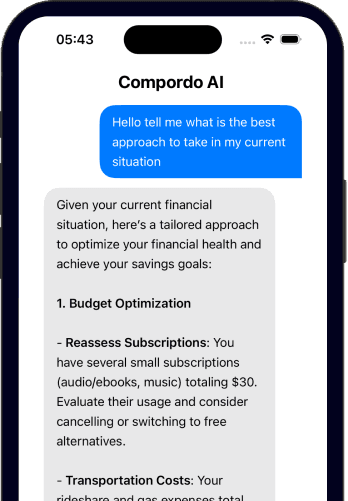

### 1. Compordo – Best Overall for Students (Free Plan)

**Why it's perfect for students:**

- **Free plan** includes AI budgeting essentials

- Automatically categorizes transactions (no manual work)

- Tracks multiple income sources (job, parents, side hustles)

- Investment tracking for students building wealth early

- Mobile-first design (manage money between classes)

**Pricing:** Free (Premium $9.99/month optional)

**[Start Free →](https://www.compordo.com)**

### 2. Mint – Popular Free Option

**Student-friendly features:**

- Completely free with ads

- Bill tracking and reminders

- Credit score monitoring (important for first credit card)

- Goal setting for spring break, laptop, etc.

**Limitations:** Less advanced AI compared to Compordo, ads can be distracting

### 3. Goodbudget – Best for Envelope Budgeting

**How it works:**

- Digital envelope system (allocate money to categories)

- Free version: 10 envelopes, 1 account

- Great for students who like visual budget separation

**Best for:** Students who respond well to "buckets" of money

### 4. PocketGuard – Best for "Money Available to Spend"

**Key feature:**

- Shows exactly how much you can spend after bills and goals

- "In My Pocket" calculation (total - bills - savings = spendable)

- Automatic categorization

**Pricing:** Free basic; Premium $7.99/month or $34.99/year

### 5. YNAB (You Need A Budget) – Best for Serious Students

**Pros:**

- Powerful zero-based budgeting

- **Free for students** (verify with .edu email - 12 months free)

- Excellent mobile apps

**Cons:**

- Steeper learning curve

- $99/year after student discount expires

## How AI Budgeting Saves Students Money: Real Examples

### Example 1: Coffee & Dining Out

**Without AI:**

- "I grabbed coffee a few times this week, maybe $20?"

- Reality: $85 spent on coffee, $240 on eating out

**With AI (Compordo):**

- Alert: "You've spent $85 on coffee this month (12 transactions)"

- "Your dining spending ($325) is 2x your budget"

- Instant awareness → behavior change

**Student savings:** $150-200/month by cutting unnecessary spending

### Example 2: Forgotten Subscriptions

**Student trap:**

- Free trials that auto-renew (Amazon Prime Student, streaming services)

- Gym memberships used twice

- App subscriptions forgotten

**AI catches:**

- "Unused subscription: Hulu $15.99/month"

- "Gym membership: $39/month, last visit 4 months ago"

- "Spotify Premium: Family plan available (save $5/month)"

**Average savings:** $30-60/month in forgotten subscriptions

### Example 3: Textbook & Course Materials

**Traditional approach:**

- Bookstore panic shopping: $600 on textbooks

- Didn't compare prices or look for used options

**AI budgeting approach:**

- Track what you actually spent last semester

- AI alerts when textbook spending exceeds budget

- Plan ahead with savings goal for next semester

**Savings:** $200-400/year through awareness and planning

### Example 4: The "Invisible" Small Purchases

**Without tracking:**

- $8 Starbucks

- $12 DoorDash delivery fee

- $15 impulsive Amazon purchase

- $6 vending machine snacks

- **Total: $41/day × 20 days = $820/month** (invisible drain)

**With AI:**

- Daily spending alerts show pattern

- "Small purchases" category totals $820

- Shock value triggers behavior change

**Savings:** Reducing 50% of impulse purchases saves $400/month

## Step-by-Step: Setting Up AI Budgeting as a Student

### Step 1: Choose Your App (Week 1)

**For most students:** Start with [Compordo's free plan](https://www.compordo.com)

**Why:**

- No cost commitment

- Full AI features on free plan

- 5 minutes to set up

- Works with student checking accounts

### Step 2: Connect Your Accounts (15 minutes)

**Connect:**

- Student checking account

- Credit card (if you have one)

- Venmo/Cash App (where students actually spend)

- Student loan accounts (to track, not pay from app)

**Security:** Read-only access, bank-level encryption, can't move your money

### Step 3: Let AI Categorize for 1 Week

**Don't do anything!** Just let AI watch your spending:

- AI automatically categorizes transactions

- Learns your patterns (Chipotle = dining, Target = varies)

- Builds baseline understanding

**Week 1 goal:** See where money actually goes (prepare for reality check)

### Step 4: Review AI's Spending Insights (Week 2)

**Check these AI insights:**

- Which category do you spend most on?

- How much on "wants" vs. "needs"?

- Any forgotten subscriptions?

- Comparison to similar students (some apps)

**Common student discoveries:**

- "I spent HOW MUCH on food delivery?!"

- "I didn't realize that subscription was still charging me"

- "My coffee habit costs $1,020/year"

### Step 5: Set Realistic Student Budgets (Week 2)

**Use AI's suggested budgets** based on your actual spending:

**Typical student budget categories:**

- **Housing/Rent:** Usually fixed, set and forget

- **Groceries:** AI suggests based on past 2-3 months (e.g., $200/month)

- **Dining Out:** This is where students overspend (AI might suggest $150, you currently spend $320)

- **Transportation:** Gas, Uber, parking (AI spots patterns)

- **Entertainment:** Movies, concerts, bars (be honest!)

- **Personal Care:** Haircuts, toiletries, etc.

- **Subscriptions:** All streaming, apps, gym

- **Books/School Supplies:** Semester-based spikes

**Pro tip:** Don't set unrealistic budgets you'll break immediately. AI's suggestions based on YOUR data are smarter than generic advice.

### Step 6: Enable Spending Alerts (Week 3)

**Set up notifications:**

- ⚠️ When you hit 75% of any category budget

- 🚨 When you exceed any category

- 📱 Daily spending summary (optional, great for accountability)

- 💰 Large transaction alerts ($50+)

**These alerts prevent overspending BEFORE it becomes a problem.**

### Step 7: Check In Weekly (5 minutes)

**Sunday night routine:**

- Open app

- Review week's spending

- Check budget progress

- Plan next week adjustments

**Total time:** 5 minutes/week = 20 minutes/month (vs. 6+ hours with manual budgeting)

## Student Budget Hacks with AI

### Hack 1: The "Pay Yourself First" Automation

**Setup:**

1. Open separate savings account (many banks have free student accounts)

2. Set up auto-transfer: $25-50 each payday → savings

3. Track in AI app as "Savings" category

4. **Don't touch it** (emergency fund building)

**Result:** $25/week = $1,300/year saved without thinking about it

### Hack 2: The "Guilt-Free Spending" Category

**How it works:**

- Set aside $40-60/week as "fun money"

- Once it's gone, no more impulse purchases

- AI tracks it automatically

- No guilt when you spend it (it's budgeted!)

**Why students love it:** Balances responsibility with college fun

### Hack 3: The Semester Savings Plan

**Problem:** Textbooks, deposits, and other big semester expenses hit all at once

**AI solution:**

1. Set savings goal: "$600 for fall semester expenses"

2. Deadline: August 15

3. AI calculates: "Save $50/month for 12 months"

4. Track progress automatically

**No more panic:** You're prepared for semester costs

### Hack 4: The Side Hustle Tracker

**For students with multiple income sources:**

- Part-time job (regular)

- Tutoring (irregular)

- DoorDash/Uber (variable)

- Selling stuff online (sporadic)

**AI benefit:**

- Tracks all income automatically

- Shows which gigs are most profitable per hour

- Helps plan budget around variable income

**Example:** AI shows tutoring earns $35/hour vs. DoorDash $18/hour → prioritize tutoring

### Hack 5: Shared Expense Splitting

**Student living situation:** Roommates split groceries, utilities, Costco runs

**AI tracking:**

- Tag transactions as "shared"

- Note who owes what in app notes

- Use Venmo integration to track reimbursements

- No more "wait, did you pay me back for pizza?"

## Common Student Budgeting Mistakes (AI Prevents)

### Mistake 1: Unrealistic Budgets

❌ **Traditional:** "I'll spend $30/month eating out" (while currently spending $300)

✅ **AI approach:** "You spent $285/month average. Try $250 first."

**Why it works:** Small improvements you'll actually stick to

### Mistake 2: Forgetting Irregular Expenses

❌ **Traditional:** Budget monthly, forget annual costs (car insurance, Amazon Prime)

✅ **AI approach:** Tracks recurring annual/semester expenses automatically

### Mistake 3: Not Tracking Cash/Venmo

❌ **Traditional:** Only track debit card, ignore $50 cash from ATM

✅ **AI approach:** Connect Venmo, Cash App; manually log cash if needed

### Mistake 4: Giving Up After One Bad Week

❌ **Traditional:** Overspend, feel guilty, abandon budget

✅ **AI approach:** AI shows you're still within monthly budget, one bad week ≠ failure

**Insight:** AI's longer-term view prevents discouragement

### Mistake 5: Not Planning for Summer

❌ **Traditional:** Spend freely during school year, panic in summer with no income

✅ **AI approach:** Build "summer savings" during school year when working

## AI Budgeting + Student Loans: Smart Strategy

### What AI Can Do:

✅ **Track loan balances** (know what you owe)

✅ **Monitor payment due dates** (never miss payment)

✅ **Calculate payoff timeline** with extra payments

✅ **Show impact** of paying extra $50/month

### What Students Should Do:

1. **Connect loan accounts** to AI budgeting app (read-only, safe)

2. **Make minimum payments** while in school if required

3. **Save extra** for lump sum at graduation (better than early payments during school)

4. **Track your total debt** to stay motivated

**AI advantage:** Full financial picture (loans + spending + saving) in one place

## Building Wealth as a Student with AI

**Controversial truth:** Some students CAN invest while in school

### When Students Should Invest:

✅ Have emergency fund ($500-1,000 minimum)

✅ No high-interest debt (credit cards)

✅ Consistent income (part-time job)

✅ Living within budget (spending < earning)

### How AI Helps Student Investors:

**Track investments + budget together:**

- [Compordo](https://www.compordo.com) tracks stocks, crypto, and budget in one app

- See how investing impacts overall finances

- Monitor portfolio performance alongside spending

**Start micro-investing:**

- Invest $25-50/month (that's 2-3 fewer Chipotle trips)

- AI tracks investment account like any other account

- Compound interest works magic over 40+ years

**Example:**

- **$50/month invested** from age 20-30 (10 years)

- Then **$0** from 30-65 (never add another dollar)

- At 8% return: **$175,000** at retirement

- **Same $50/month** starting at age 30 instead: Only $84,000

**Takeaway:** Starting young >> investing large amounts later

## Free Student Money Resources

**Complement your AI budgeting with:**

1. **NerdWallet** - Student credit card comparisons

2. **Undebt.it** - Debt payoff calculator

3. **StudentAid.gov** - Loan info and repayment calculators

4. **r/StudentLoans** - Reddit community advice

5. **r/personalfinance** - Wiki has student section

6. **Compordo Discord** - Chat with other students about money

## Real Student Success Stories

**"I saved $347 in the first month just by seeing where my money went. Cutting DoorDash alone saved $150/month."**

— Sarah, 20, Sophomore

**"The subscription alerts caught 3 things I forgot about: $43/month I'm now saving."**

— Marcus, 22, Senior

**"I'm actually building an emergency fund for the first time. AI budgeting made it automatic and easy."**

— Jessica, 19, Freshman

**"Showing my parents my budget (from the app) convinced them to help more with textbooks because they could see I'm being responsible."**

— David, 21, Junior

## Conclusion: Start Your Financial Future Today

You don't need to be a finance major to master your money. AI budgeting tools make it simple, automatic, and actually effective—perfect for busy students.

**The student advantage:** Start building smart money habits NOW, and they'll compound over your entire life (just like investments).

### Your Action Plan:

**This week:**

1. ✅ Choose AI budgeting app ([Compordo free plan](https://www.compordo.com) recommended)

2. ✅ Connect accounts (15 minutes)

3. ✅ Let AI track spending for 1 week

**Next week:**

4. ✅ Review AI insights (reality check moment)

5. ✅ Set realistic budgets based on AI suggestions

6. ✅ Enable spending alerts

**Ongoing:**

7. ✅ Check app 5 minutes/week

8. ✅ Adjust as needed

9. ✅ Celebrate savings wins

**Time investment:** 30 minutes setup + 5 minutes/week

**Money saved:** $100-500/month (average student)

**Lifetime impact:** Priceless

**Start building wealth, not debt. Your future self will thank you.**

[Start Free AI Budgeting →](https://www.compordo.com)

---

*Student money questions? Join our [Discord community](https://discord.gg/wxRnk2Pmrt) where students share budgeting tips and wins!*